Notwithstanding the growth of renewables and energy efficiency gains, in most regions of the world demand for oil and gas has continued to grow alongside that for energy. IOGP’s new Global Production Report shows oil demand stood 30% higher in 2018 than in 2000, while natural gas demand increased even more dramatically by 60% during the same period.

Source: IOGP

With the exception of Europe and Central & South America where demand is stagnating or in slow decline, the Report shows new records for consumption across all other world regions in 2018. This could turn some of the largest exporting regions such as Africa into importers in the coming years.

This growth highlights the importance of responsible resource development policies and the need for continued significant investments to make up for the average 6% depletion rate of existing fields.

Commenting on the new study, IOGP Executive Director Gordon Ballard says:

“This third edition of our Global Production Report shows once again why failing to invest in existing and future oil & gas fields is simply not an option given global market needs. IOGP and its members continuously work to respond to the dual challenge of providing more energy with a lower carbon footprint, in the spirit of the Paris Agreement goals.”

Main Findings

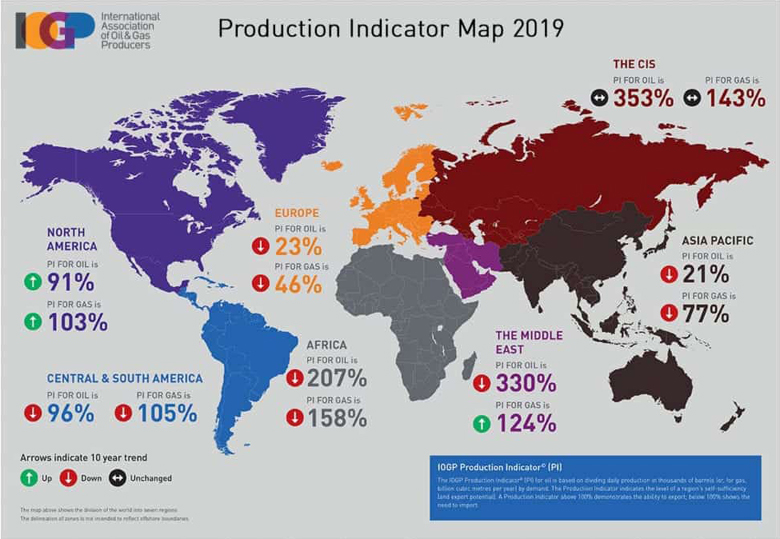

The IOGP Production Indicator© (PI) shows the level at which each of seven regions is able to meet its own oil or gas demand. A PI higher than 100% means the region produces more than it needs to meet its own requirements and can therefore export.

The regions can be divided in three distinct groups when it comes to supply/demand balance: net importers (Europe, Asia Pacific) those at or near self-sufficiency (Central & South America and North America), and those that are net exporters of oil & gas (Africa, CIS and the Middle-East).

The Report’s data is based on material drawn from the latest BP Statistical Review of World Energy. Each regional spread also features a commentary section by an IOGP Member active in that part of the world.

For example, although Africa’s oil PI of 207% is still healthy, the region’s oil export potential has dropped by 40% in a decade. This trend will have to watched carefully, since oil demand in Africa is expected to increase dramatically. Similarly, Africa’s gas export potential has decreased by 20% in the past 10 years. If this trend continues, Africa could become a gas importer.

KeyFacts Energy Industry Directory: IOGP l Access the IOGP Global Production Report

KEYFACT Energy

KEYFACT Energy