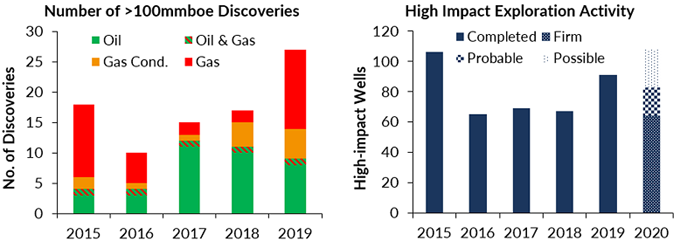

The Energy Transition and Extinction Rebellion may have led the energy news agenda and stimulated reflection in many E&P boardrooms in 2019, but the impact on exploration drilling is not yet apparent. The global high impact well[1] count in 2019 was 91 wells, up 36% on 2018. Drilling spend was flat at $3.5 billion, however, as average well costs fell. Discovered commercial volume was the highest since 2015 at around 13 billion barrels of oil equivalent (boe) from the 27 high impact discoveries announced so far. The commercial success rate was at a 10-year high of 32%. This level of activity looks likely to be sustained through 2020.

77% of total estimated 13bn boe discovered was gas, with seven of the top ten discoveries being gas in Russia (2), Iran, Mauritania, Senegal, Indonesia and Cyprus. The two biggest oil discoveries were both in the Stabroek licence in Guyana, which at 6 billion barrels and counting, is one of the most prolific oil licences ever issued.

Commercial discoveries of 100 million barrels of oil equivalent or bigger 2015-19 and high impact well count and forecast for 2020. Source: Westwood Analysis

2019 was the year that North West Europe topped the charts for high impact drilling globally. This was extraordinary given the maturity of the plays in the UK and Norway. Unfortunately, and some would say predictably, only two high impact discoveries resulted from the 27 well programme – Glengorm in the UK and Liatårnet in Norway. This is a woeful success rate of only 7%. Two wells are still drilling and could yet deliver discoveries, but the low discovery rate should cause pause for thought and the high impact well count should drop in 2020.

Guyana topped the oil discovery charts again in 2019 with the Liza field coming onstream in December and another billion barrels added in the Exxon operated Stabroek licence with some more gas also. The five commercial discoveries in 2019 bring the total so far to 14 but it wasn’t all plain sailing. The Tullow operated JV made two play opening discoveries that first sounded promising but turned out to be heavy and sour, contributing to a dramatic fall from grace for Tullow with its share price crashing.

Already the oil volume discovered and planned for development is far more than the tiny economy of Guyana can handle and the pace may have to slow 2020 if Guyana is to cope. There is still much to learn about both the plumbing of the petroleum system and the robustness of the political system – expect more surprises. The industry will nonetheless continue to try to push the boundaries of the play beyond the Stabroek licence into both shallower and deeper Guyanese waters. The significant Maka Central discovery operated by Apache and announced in January 2020 looks to be the first commercial discovery outside of Stabroek, extending the play into neighbouring Suriname.

In Mexico, the 5 high impact exploration wells completed by international oil companies in 2019 failed to deliver a commercial discovery (with one still drilling). In 2020 it should become clearer whether Mexico will deliver the bounty that IOCs hoped for with at least 10 wells operated by seven different IOCs testing over 2.5 billion barrels of unrisked prospective volume in a range of frontier and emerging plays. The geology is complex and mixed results can be expected.

Brazil is another country to watch in 2020 with one high impact well currently drilling and seven wells planned for 2020 in recently awarded licences testing 6 billion barrels of unrisked volume in pre-salt plays in the Santos and Campos basins, and the Ceara Basin. Exxon will operate its first two wells since its re-entry and Premier will operate its first well in the Ceara Basin. It’s not going to be shooting fish in a barrel in the Santos Basin though with several wells being drilled outside the proven pre-salt play. The much anticipated Peroba well drilled in 2019 by BP, for which a $598 million signature bonus was paid in the 2017 bid round, is understood to have found high CO2 content gas and is considered non-commercial.

In Africa, high impact drilling remained subdued at 14 wells completed in 2019 but commercial success rates were high at 57% with over 3 billion boe discovered of which ~80% was gas. There was one frontier play opening gas condensate discovery at Brulpadda in South Africa and there were high impact discoveries in five other countries – Senegal, Mauritania, Nigeria, Angola and Ghana. In 2020, a similar number of high impact wells are expected spread across 10 countries with potentially six frontier play tests in Guinea Bissau, Kenya, Namibia and Gabon. Total is testing a new play concept at a well in Block 48, Congo Basin Angola, notable for being the deepest water exploration well ever at over 3600m.

In the emerging gas plays of the Eastern Mediterranean there were six wells drilled and two commercial discoveries delivering 5 tcf. Three of the six wells were drilled by TPAO, two of which were in the Cyprus area and were political rather than technical tests. Five wells testing 16 tcf of gas are planned in 2020 including Total’s Byblos-1 well offshore Lebanon.

Drilling in Australasia is set to pick up in 2020 after a quiet 2019 with one potentially high impact gas discovery made in the onshore Perth Basin at the West Ereggulla well. In 2020 high impact drilling is mainly about gas with wells planned in Australia, New Zealand, PNG and Timor Leste testing over 10 tcf of gas most of which are testing frontier plays. South East Asia was quiet in 2019 with just three high impact wells and two high impact discoveries in Indonesia and Malaysia discovering 5 tcf of gas.

Based on current plans it looks like high impact drilling could be at a similar level to 2020 but with shift of focus to North and South America. Westwood estimates that industry drilling plans are weighted 70/30 oil to gas. Whilst recognising that the industry has had a habit of finding gas when looking for oil it doesn’t seem the appetite for finding oil is diminishing. The four most active companies in 2020 are expected to be the European Supermajors Total, Equinor, Shell and ENI, each participating in 14 or more high impact wells. Whilst there has been much talk about the energy transition in 2019, there is little sign of its impact on exploration plans for 2020.

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy