Wentworth, the AIM listed independent, East Africa-focused natural gas company announces the following operational and reserves update.

Highlights

- 2019 full year average daily production from Mnazi Bay of 70.29 MMscf/d (gross)

- Mnazi Bay production 2020 production guidance 65 - 75 MMscf/d (gross)

- MB-2 flowline repaired and MB-4 Lower Mnazi Bay recompleted, increasing operational flexibility and enabling field to produce at sustained rates > 100 MMscf/d

- Final term loan debt repayment made 31 January 2020

- End 2019 net cash position of $13.5m

- Wentworth's share of Gross 2P Reserves as at 31 December 2019 estimated by RPS to be 95.1 Bcf (15.8 mmboe) with a post-tax NPV10 of $118.6 million

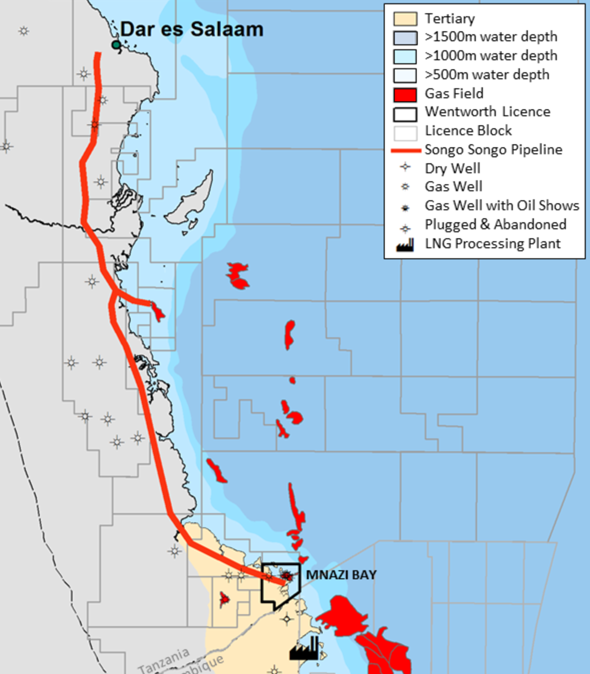

Map source Wentworth Resources

Mnazi Bay Operations

Full year average production from Mnazi Bay for 2019 was 70.29 MMscf/d (gross), at the mid-point of the revised guidance range of 68 - 72 MMscf/d issued on 19 November 2019. This was despite several challenges during the year, including abnormally high rainfall resulting in hydro-power displacing gas-generated power, increased competitive gas supply from the Songo Songo field into the National Natural Gas Infrastructure ("NNGI") pipeline, and the temporary shut-in of the MB-2 well.

Recent operational highlights include:

- The MB-2 flowline repairs were completed and the well was returned to production on 21 December 2019; and

- The MB-4 was recompleted to include access to the Lower Mnazi Bay sands, which has increased the production potential of the well by c. 15 MMscf/d.

Completion of the MB-2 flowline repairs and the recompletion of the MB-4 well is expected to allow the JV Partners to sustainably supply gas at rates in excess of 100 MMscf/d to meet the demand needs of Tanzania.

Mnazi Bay Operational Outlook

Modest growth in gas-fired power generation is likely to be offset by continued strong hydro-power, a product of unusually high rainfall outside the normal wet season and continued competitive gas from Songo Songo:

- In 2019, both the long (April-June) and short (December) rainy seasons had more than twice the total rainfall and had a longer duration than any corresponding period during the previous decade. In January 2020, rainfall totals have been above long-term averages and have resulted in subdued gas demand. If rainfall totals are more similar to those observed between 2008-2018, there will be potential for higher demand, and thus higher gas deliveries.

- As previously stated, Pan Africa Energy Tanzania ("PAET") began gas sales into the NNGI in December 2018 under a new Gas Sales Agreement ("GSA"), which provides for gas sales of 20 -30 MMscf/d. The allocation between Mnazi Bay and Songo Songo gas to date suggests that increased demand will be split proportionate to our GSA totals until the upper end of the PAET GSA is met, at which point management expects that additional demand will be supplied by Mnazi Bay.

- In September 2019, the JV Partners reached a full GSA with Tanzania Petroleum Development Company ("TPDC"), which includes a take-or-pay provision at 85 per cent. of the daily committed quotient ("DCQ"). The DCQ was mutually agreed at 80 MMsf/d for 2020, which means that if annual volumes fall below 68 MMscf/day the take-or-pay clause will take effect. This excludes 2 - 2.5 MMscf/d of gas sold to Mtwara.

Accordingly, guidance for 2020 has been set at 65 - 75 MMscf/d (gross) and will be reviewed at the half year point, after the end of the typical longer rainy season. The JV Partners have agreed a limited 2020 firm work programme totaling approximately $4.6 million net to Wentworth.

Financial Update

The Company continues to receive consistent monthly payments for gas sales with receivables from TPDC now standing at just one month. As anticipated, the Company has now fully repaid its term loan, having made its final repayment of $1.67 million plus interest on 31 January 2020. The Company's net cash balance at 31 December 2019 was $13.5 million. In accordance with the Company's dividend policy, established last year, Wentworth expects to declare its final dividend for 2019 with the Company's preliminary results in April.

Reserves Update

RPS Group, an independent third party reserves evaluator, performed a Competent Persons Report ("CPR") for the Company with an effective date of 31 December 2019. The updated full field 2P gross reserves for Mnazi Bay are 468.9 Bcf (95.1 Bcf being Wentworth's share of net reserves). This compares to 481.9 Bcf at 31 December 2018, despite production throughout 2019 of 25.7 Bcf. The fact that reserves decreased by less than production is attributable to the stronger than anticipated pressures measured across the field, which indicates larger in-place and recoverable volumes.

The NPV10 after tax for the 2P reserves at 31 December 2019 is $118.6 million net to Wentworth. This compares to $128.7 million for 2018. It should be noted that during 2019, Wentworth increased its cash position by $4.0 million and made total debt repayments of $7.3 million (including interest), while returning $1.0 million to shareholders through its maiden interim dividend.

KEYFACT Energy

KEYFACT Energy