More oil and gas were discovered in stratigraphic traps than any other trap type in the last decade. Excelling in stratigraphic trap exploration is now the key to top quartile exploration performance.

In a new report* Westwood has analysed stratigraphic trap exploration between 2008 and 2019 in 66 basins and 113 different plays. It found that 35 bnboe has been discovered in clastic stratigraphic traps since 2008, comprised of 22 bnboe (132 tcf) of gas and 13 bnbbl of oil. Seventy five percent of the oil resources and 95% of the gas resources were discovered in deep water.

Oil and gas commercial resources discovered in stratigraphic traps since 2008 in basins with more than 5 stratigraphic trap tests

Source: Westwood Wildcat & Google Maps

The most prolific basins were Suriname-Guyana, the MSGBC, the Rovuma-Rufiji and the Colville, where major new plays dominated by stratigraphic traps emerged in the period. Upper Cretaceous aged stratigraphic traps delivered 42 commercial discoveries, with a total of 9 bnbbl of oil and 39 tcf of gas, of which 7 bnbbl of the oil is in the Suriname-Guyana basin and 20 tcf is in the MSGBC basin. Oligocene aged plays delivered 7 commercial discoveries with a total 40 tcf of gas – of which 36 tcf was in the Ruvuma basin in Mozambique.

There were also notable disappointing campaigns targeting stratigraphic traps in the Carnarvon, Sierra Leone-Liberia and Central North Sea basins from which important lessons have been learned.

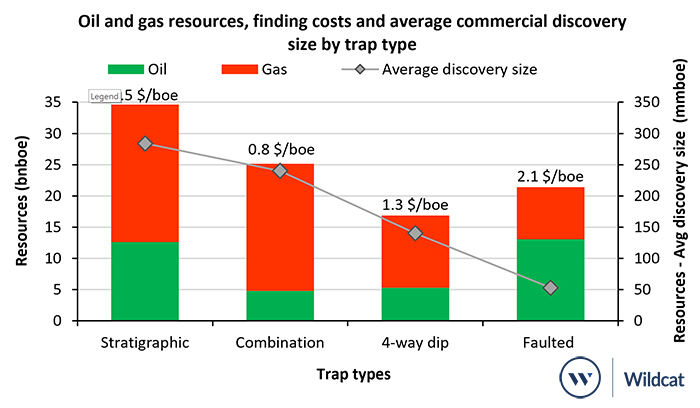

Stratigraphic traps had a larger average discovery size of 280 mmboe, and a lower drilling finding cost of 0.5 $/boe, compared to other traps types in the period. Stratigraphic traps had a commercial success rate (CSR) of 32%, in line with other trap types. The evidence shows they are not higher risk than other traps, contrary to many explorers’ preconceptions.

Commercial oil and gas resources, average commercial discovery size and drilling finding cost by trap types

Industry is also getting better at exploring for stratigraphic traps with the CSR increasing to 50% in the 2017-2019 period from 21% between 2014-2016. The more effective use of seismic attributes and better integration with geological models has had an impact in some basins.

Marine turbidite sandstones in stratigraphic traps in passive margin settings were the most targeted delivering 31 bnboe (90%) of discovered commercial resources. For marine turbidite plays, stratigraphic traps on graded slopes in the lower slope to basin floor settings performed best in terms of both discovered volumes and success rates. Finding stacked traps or extensive traps was key to commercial success.

Commercial oil and gas resources, average commercial discovery size by location on the slope

Commercial deep-water standalone discoveries of >300 mmbbl in clastic reservoirs are now most likely to be found in stratigraphic traps and traps with stratigraphic components. Excelling in stratigraphic trap exploration is a must for today’s exploration companies and Westwood’s new report points the way.

Keith Myers, President Research, kmyers@westwoodenergy.com l For more information on the report, click here

KeyFacts Energy Industry Directory: Westwood Global Energy

KEYFACT Energy

KEYFACT Energy