BP has today reported first quarter 2020 results.

Highlights

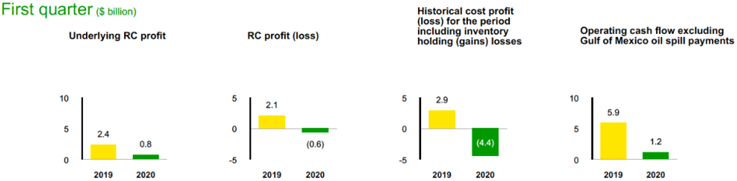

- Underlying replacement cost profit for the first quarter was $0.8 billion, compared with $2.4 billion for the same period a year earlier. The result reflected lower prices, demand destruction in the Downstream particularly in March, a lower estimated result from Rosneft and a lower contribution from oil trading. It was also impacted by $0.2 billion non-cash underlying foreign exchange (FX) effects in other businesses and corporate, including FX translation impacts of finance debt in the BP Bunge Bioenergia joint venture.

- Replacement cost loss for the first quarter was $0.6 billion, compared with a profit of $2.1 billion for the same period a year earlier, including a $1.4 billion net adverse impact of non-operating items and fair value accounting effects.

- Inventory holding losses of $3.7 billion, as a result of the dramatic drop in oil prices at the quarter end, were the main driver of the reported historical cost loss of $4.4 billion.

- Operating cash flow for the first quarter, excluding Gulf of Mexico oil spill payments, was $1.2 billion, including a $3.7 billion working capital build (after adjusting for net inventory holding losses) driven by higher Downstream product balances and trading mark-to-market receivable balances at the end of the quarter. Gulf of Mexico oil spill payments in the quarter were $0.3 billion on a post-tax basis.

- Receipts from divestments and other proceeds were $0.7 billion in the first quarter.

- Net debt at the end of the quarter was $51.4 billion, $6.0 billion higher than a quarter earlier. Also reflecting lower equity including FX impacts, gearing at quarter end was 36.2%.

- At the end of the quarter BP had around $32 billion of liquidity available.

- A dividend of 10.5 cents per share was announced for the quarter.

Bernard Looney, Chief Executive Officer, commented:

This extraordinary time for the world demands extraordinary responses. And thankfully we are seeing that just about everywhere we look around the world. Our industry has been hit by supply and demand shocks on a scale never seen before, but that is no excuse to turn inward. BP, like many other companies, is stepping up and extending a helping hand to those in need. We do it not because it is expected of us – but because we want to. That is consistent with our purpose.

We are focusing our efforts on protecting our people, supporting our communities and strengthening our finances. I am incredibly proud of the work that our people are doing in all three areas, particularly our colleagues in operations – from rigs to retail and everywhere in between – who are continuing to deliver energy and provide goods in the most difficult of circumstances. At the same time, we are taking decisive actions to strengthen our finances – reinforcing liquidity, rapidly reducing spending and costs, driving our cash balance point lower.

We are determined to perform with purpose and remain committed to delivering our net zero ambition.

Dividend

BP announced a quarterly dividend of 10.5 cents per ordinary share ($0.63 per ADS), which is expected to be paid on 19 June 2020.

Outlook

- The economic impact of the COVID-19 pandemic coupled with pre-existing supply and demand factors have resulted in an exceptionally challenged commodity environment. Product demand has sharply reduced, notably for mobility, contributing sharp falls in refining margins and utilization. The resulting reduction in demand for crude oil has begun to put severe pressure on storage and logistics, with a substantial effect on prices and has promoted volatility. In April, OPEC and its partners agreed to significant supply cuts that are expected to help reduce the imbalance but are unlikely to prevent material supply shut ins by oil producers in the near-term, some of which may be difficult to reverse. Challenges in gas markets, following significant growth in supply over recent years, have been compounded by the pandemic, lowering LNG demand.

- In March, Brent crude marker prices and BP’s refining marker margin touched levels not seen for well over a decade, while Henry Hub gas price hit multi-year lows and prices and margins have continued to remain depressed.

- Looking forward, there remains an exceptional level of uncertainty regarding the near-term outlook for prices and product demand, particularly while many economies remain under lockdown. There is the risk of more sustained consequences depending on the efforts of governments and the public and private sectors to manage the health, economic and financial stability effects of the pandemic.

- Upstream second-quarter reported production is expected to be lower compared to the first quarter. There are significant uncertainties with regard to the implementation of OPEC+ restrictions, price impacts on entitlement volumes, divestments, market restrictions given lack of demand for oil and COVID-19 operational impacts.

- In Downstream, material impacts from COVID-19 are expected in the second quarter. Product demand in fuels marketing is expected to be significantly lower in BP’s key European and North America businesses. In refining, reduced utilization is expected due to the overall product demand declines, as well as significantly lower refining margins. In addition, a lower level of North American heavy crude discounts is expected.

- During the second quarter BP also expects to make the annual payment of around $1.2 billion relating to the Gulf of Mexico spill settlement.

- Gearing is expected to remain above the 20 to 30% target range into 2021. It is expected to trend down over time reflecting receipt of divestment proceeds and reversal of first quarter working capital impacts, and as BP’s financial interventions take effect.

- BP's future financial performance, including cash flows, net debt and gearing, will be impacted by the extent and duration of the current market conditions and the effectiveness of the actions that it and others take, including its financial interventions. It is difficult to predict when current supply and demand imbalances will be resolved and what the ultimate impact of COVID-19 will be.

Key financial highlights

- BP is taking a series of interventions to strengthen its finances.

- BP has strengthened its balance sheet, with around $32 billion of liquidity at quarter end, including a new $10 billion revolving credit facility. In April BP has issued around $7 billion of new bonds.

- 2020 organic capital spending is expected to be around $12 billion, a reduction of around 25% on full-year guidance given in February. In the Upstream, most of the interventions are being made in areas not expected to have a significant impact on 2020 cash generation at lower prices. These include delaying exploration and appraisal activities and curtailing development activities in lower margin areas, as well as rephasing or minimizing spend on projects in the early phases of development. These interventions are expected to reduce 2020 underlying production by around 70mboe/d compared with 2019. In Downstream, the capital expenditure reduction contribution is expected to be around $1 billion in 2020. Interventions are primarily related to growth projects and are also not expected to have a significant impact on operating cash in the short term. BP expects to continue to invest around $500 million in low-carbon activities in 2020.

- BP plans to reduce cash costs by $2.5 billion by the end of 2021 relative to 2019. The reduction is expected to result both from costsaving measures across BP’s business as well as an important contribution from actions including increased digitisation, further integration and removing duplication, and new ways of working. Some of these cost savings may have associated restructuring charges.

- The programme to deliver $15 billion of announced transactions by mid-2021 remains on track, although the current market environment remains challenging. BP has delivered $10.1 billion of announced transactions since the start of 2019. The phasing of receipt of $10 billion of divestment proceeds by the end of 2020 will be revised as transactions complete. BP has reconfirmed its commitment to completing the sale of its Alaska business to Hilcorp in 2020, subject to regulatory approvals. The total consideration of $5.6 billion is unchanged but the structure of the consideration and phasing of payments have been revised to respond to the current environment.

- BP will continue to review these actions, and any further actions that may be appropriate, in response to changes in prevailing market conditions.

Brian Gilvary – Chief financial officer:

“We are dealing with an exceptionally challenging environment and the unprecedented effects of demand destruction and price impacts that can be seen in these results are expected to continue through the second quarter. Despite this our underlying businesses performed well in the first quarter, although our headline results were impacted by foreign exchange as well as price effects at the quarter end. We have developed a clear plan and are confident in increasing resilience in our financial framework through a set of interventions focused on building liquidity, strengthening our balance sheet and reducing expenditure to drive our cash balance point below $35 per barrel in 2021.”

Upstream

Upstream production for the first quarter, which excludes Rosneft, was 2,579mboe/d, 2.9% lower than a year earlier. Underlying production, adjusted for portfolio changes and entitlement impacts, was 0.7% higher than a year earlier, mainly due to reduced turnaround activities.

Upstream is making progress in the divestment programme including the completion of the sale of the San Juan, Arkoma and Anadarko fields in the US onshore and the recent announcement confirming that BP expects to complete the sale of its Alaska business in 2020.

BP continues to progress its major projects. The COVID-19 pandemic is slowing progress on some projects and impacts are currently being assessed. Of the 900mboe/d major project growth targeted for 2021, 700mboe/d is currently online.

KeyFacts Energy: BP UK country profile

KEYFACT Energy

KEYFACT Energy