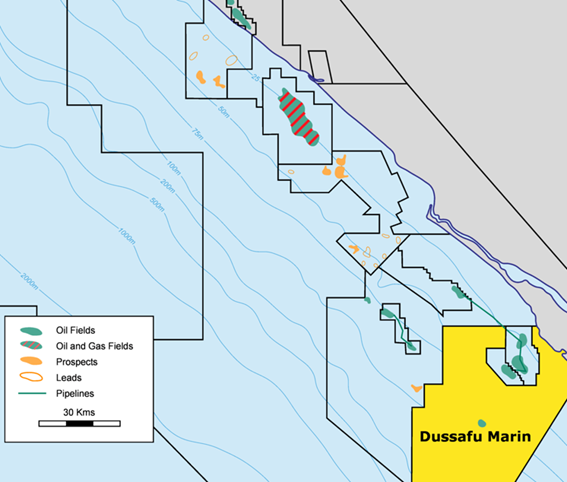

BW Energy provides the following an update on operation and development of the operated Dussafu Marin license in Gabon and impact from the COVID-19 pandemic. Production activities in Gabon remain uninterrupted as BW Energy complies with public health regulations at all its locations to protect the health of employees and partners, ensure safe operations and contribute to stopping the spread of coronavirus.

Map source: KeyFacts Energy

FIELD OPERATIONS IN LINE WITH EXPECTATIONS

Dussafu daily operations continue to perform in line with expectations with four wells (DTM-2H, DTM-3H, DTM-4H and DTM-5H) producing to the FPSO BW Adolo at a current rate of approximately 17,500 bbls/day oil production (gross).

Gross production from Tortue averaged 11,485 bbls/day for the first quarter of 2020 and total gross production was 1,045,100 bbls of oil. One lifting was completed by BW Energy in the quarter realising an average price of about USD 33 per barrel. Production cost (excluding royalty) was USD 21.8 per barrel.

BW Energy share of gross production was 768,150 bbls of oil. Net sold volumes, which are the basis for revenue recognition in the financial statement, were 427,647 bbls, reflecting overlift position of 375,500 bbls at the end of the first quarter. The lifting took place in March and reflected a lower average realised oil price.

In April, one lifting was executed by JV partner Gabon Oil Company on behalf of itself and the State of Gabon. Next lifting for BW Energy is scheduled to take place in June.

REVISED DEVELOPMENT PLANS AND OUTLOOK

Total Dussafu production for 2020 is projected to be 15,000 - 16,500 bbls/day (gross) based on four producing wells, compared to 11,800 bbls/day on average in 2019, while OPEX per barrel is expected to decrease to approximately USD 16-18 per barrel, compared to USD 21 per barrel on average for 2019.

Drilling of the DTM-6H well was completed in March and the final installation program was previously scheduled for June this year. Due to the COVID-19 situation, it is now uncertain when this well can be hooked up the FPSO BW Adolo. As international travel restrictions limit movement of essential personnel, subcontractors and equipment to and from Gabon, the Company has also suspended drilling of the planned DTM-7H well and the subsequent exploration well.

ENSURING FINANCIAL FLEXIBILITY

BW Energy has decided to defer the Ruche Phase 1 development. BWE's total revised capital spending program for 2020 now amounts to approximately USD 115 million, of which about USD 49 million was spent as of the end of March.

Net cash flow from operating activities for the first quarter of 2020 was USD 49.8 million and total available liquidity amounted to USD 168.3 million in cash with no debt as at 31 March. BW Energy is continuing the process with a reserve- based lending (RBL) facility with a syndicate of leading banks. The RBL facility will have a six-year term, with an initial amount of USD 200 million plus an accordion of USD 100 million.

"We have taken decisive action to manage the factors we control by safeguarding people, managing OPEX and deferring investments to ensure our resilience amid the current oil market turmoil," said Carl K. Arnet, the CEO of BW Energy. "Our business model enables us to quickly adapt to changing market conditions, preserve financial solidity and sustain low oil prices. When markets normalise, we can quickly resume development activity and increase production."

KeyFacts Energy: BW Offshore Gabon country profile*

* Premium profile information includes; description, overview of assets, current and planned operational activity, capex, local and corporate locations, links to 'Linkedin People', news archive and farm-in opportunities.

KEYFACT Energy

KEYFACT Energy