Hess Corporation today reported a net loss of $2,433 million, or $8.00 per common share, in the first quarter of 2020, including impairment and other after-tax charges of $2,251 million resulting from the low price environment, compared with net income of $32 million, or $0.09 per common share, in the first quarter of 2019. On an adjusted basis, the Corporation reported a net loss of $182 million, or $0.60 per common share, in the first quarter of 2020. The decrease in after-tax adjusted results compared with the prior-year period primarily reflects lower realized selling prices, partially offset by higher production volumes.

Key Developments

- Implemented COVID-19 plans and precautions to protect the health and safety of our workforce and the communities where we operate and to maintain business continuity

- Reduced Exploration and Production (E&P) capital and exploratory budget for 2020 by 37 percent to $1.9 billion from the original budget of $3.0 billion

- Have crude oil put options in place for more than 80 percent of forecast 2020 net oil production; fair value of $1.1 billion at March 31, 2020

- Chartered three very large crude carriers (VLCCs) to store 2 million barrels each of May, June and July Bakken crude oil production expected to be sold in the fourth quarter of 2020, to maximize the value of Hess production

First Quarter Financial and Operational Highlights:

- Net loss was $2,433 million, or $8.00 per common share, including impairment and other after-tax charges of $2,251 million resulting from the low price environment, compared with net income of $32 million, or $0.09 per common share, in the first quarter of 2019. Adjusted net loss was $182 million, or $0.60 per common share, in the first quarter of 2020

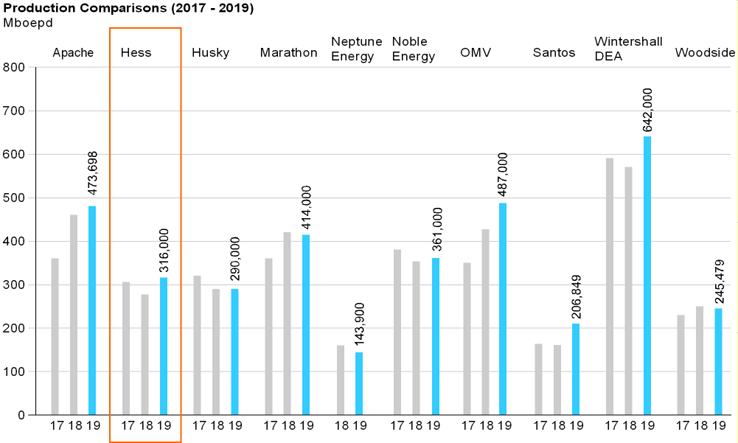

- Oil and gas net production, excluding Libya, averaged 344,000 barrels of oil equivalent per day (boepd), up from 278,000 boepd in the first quarter of 2019; Bakken net production was 190,000 boepd, up 46 percent from 130,000 boepd in the prior-year quarter

- E&P capital and exploratory expenditures were $631 million, compared with $542 million in the prior-year quarter

- Cash and cash equivalents, excluding Midstream, were $2.1 billion at March 31, 2020

2020 Revised Full Year Guidance:

- Oil and gas production, excluding Libya, is forecast to be approximately 320,000 boepd

- E&P capital and exploratory expenditures are projected to be $1.9 billion

“Our priorities in this low price environment are to preserve cash, preserve capability and preserve the long term value of our assets,” CEO John Hess said. “Our company is in a strong position to manage through this market downturn and to prosper when oil prices recover – with our low cost of supply and high return investments that will drive material cash flow growth and increasing financial returns.”

Hess Response to Global Pandemic and Market Conditions

The coronavirus (COVID-19) pandemic continues to have a profound impact on society and industry. The Corporation’s first priority in the midst of the pandemic has been the health and safety of the Hess workforce and local communities. A multidisciplinary Hess emergency response team has been overseeing plans and precautions to reduce the risks of COVID-19 in the work environment while maintaining business continuity based on the most current recommendations by government and public health agencies.

In addition to the global health concerns of COVID-19, the pandemic has severely impacted demand for oil. In response to the resulting sharp decline in oil prices, the Corporation’s focus is on preserving cash and capability, while protecting the long-term value of its assets. Hess has further reduced its E&P capital and exploratory budget for 2020 to $1.9 billion, a 37 percent reduction from the original budget of $3.0 billion. This reduction will be achieved primarily by shifting from six rigs to one rig in the Bakken and deferring discretionary spending across the portfolio including a six to twelve month deferral in the development of the Payara Field and reduced 2020 drilling activity on the Stabroek Block offshore Guyana.

As a result of the unprecedented reduction in demand due to COVID-19, commercial storage in the United States is expected to reach capacity in the second quarter, which is requiring curtailments and shut-ins of production by the industry. To maximize the value of Hess production, the Corporation has chartered three VLCCs to store 2 million barrels each of May, June and July Bakken crude oil production that is expected to be sold in the fourth quarter of 2020.

Slowing economic activity caused by the pandemic has impacted natural gas nominations at the North Malay Basin (NMB) and JDA assets in Southeast Asia. Production in the first quarter for NMB and JDA was 58,000 boepd compared to 68,000 boepd in the year ago quarter. Nominations have been reduced due to the decline in business activity and production from NMB and JDA is forecast to be approximately 35,000 boepd in the second quarter and approximately 50,000 boepd in 2020. In Guyana, the operator has temporarily idled two of the four drilling rigs on the Stabroek Block due to pandemic-related travel restrictions. The Liza Destiny floating production, offloading, and storage vessel (FPSO) is expected to reach its full capacity of 120,000 gross barrels of oil per day (bopd) in June, with April gross production of approximately 75,000 bopd. Despite pandemic-related delays, the Liza Phase 2 development remains on schedule to start production in 2022.

Exploration and Production

E&P net loss was $2,371 million in the first quarter of 2020, compared with net income of $109 million in the first quarter of 2019. On an adjusted basis, E&P’s first quarter 2020 net loss was $120 million. The Corporation’s average realized crude oil selling price, including the effect of hedging, was $45.94 per barrel in the first quarter of 2020, compared with $55.91 per barrel in the prior-year quarter. The average realized natural gas liquids (NGL) selling price in the first quarter of 2020 was $9.32 per barrel, compared with $18.46 per barrel in the prior-year quarter, while the average realized natural gas selling price was $3.16 per mcf, compared with $4.43 per mcf in the first quarter of 2019.

Net production, excluding Libya, was 344,000 boepd in the first quarter of 2020, up 24 percent from first quarter 2019 net production of 278,000 boepd. The improved performance primarily resulted from a 46 percent increase in Bakken production and the first full quarter of production at the Liza Field, offshore Guyana, which commenced production in December 2019. Libya net production was 5,000 boepd in the first quarter of 2020 and 21,000 boepd in the first quarter of 2019, reflecting the Libyan National Oil Corporation’s declaration of force majeure in January 2020 due to civil unrest.

Cash operating costs, which include operating costs and expenses, production and severance taxes, and E&P general and administrative expenses, were $9.70 per barrel of oil equivalent (boe) in the first quarter of 2020, compared with $11.00 per boe in the prior-year quarter.

Upstream Operational Highlights for the First Quarter of 2020

Bakken (Onshore U.S.): Net production from the Bakken increased to 190,000 boepd from 130,000 boepd in the prior-year quarter, with net oil production up 34 percent to 114,000 bopd from 85,000 bopd, primarily due to increased drilling activity and improved well performance. Natural gas and NGL production were also higher due to the increased drilling activity, additional natural gas captured and processed at the Little Missouri 4 natural gas processing plant that commenced operations in July 2019, and additional volumes received under percentage of proceeds contracts resulting from lower prices. The Corporation operated six rigs in the first quarter, drilling 41 wells, completing 50 wells and bringing 37 new wells online. As previously announced, the Corporation plans to reduce the rig count to one by the end of May and 2020 net production is forecast to average approximately 175,000 boepd.

Gulf of Mexico (Offshore U.S.): Net production from the Gulf of Mexico was 74,000 boepd, compared with 70,000 boepd in the prior-year quarter. The Esox-1 oil discovery in Mississippi Canyon (Hess – 57 percent) achieved first production in February as a low-cost tieback to the Tubular Bells production facilities.

Guyana (Offshore): On the Stabroek Block (Hess – 30 percent), the Corporation’s net production from the Liza Field averaged 15,000 bopd in the first quarter of 2020. The operator, Esso Exploration and Production Guyana Limited, expects the Liza Destiny FPSO to reach full capacity of 120,000 gross bopd in June. The first one million barrel cargo of oil allocated to Hess was sold in March 2020.

Phase two of the Liza Field development, which will utilize the Liza Unity FPSO with an expected capacity of up to 220,000 gross bopd, remains on target to achieve first oil in 2022. A third development, Payara, with expected production capacity of up to 220,000 gross bopd, is planned. Pending government approval to proceed, some 2020 activities at Payara are now being deferred, creating a potential delay in first production of six to twelve months beyond the initial start-up target in 2023.

In January 2020, the Corporation announced a 16th discovery at the Uaru well located approximately 10 miles northeast of the Liza Field, which encountered 94 feet of highquality oil-bearing sandstone reservoir. This discovery adds to previously reported estimated gross discovered recoverable resources for the Stabroek Block of more than 8 billion boe.

Capital and Exploratory Expenditures

E&P capital and exploratory expenditures were $631 million in the first quarter of 2020, compared with $542 million in the prior-year quarter, primarily reflecting greater activity in the Bakken, and the tiein of the Esox-1 well to the Tubular Bells production facilities in the Gulf of Mexico. E&P capital and exploratory expenditures are now projected to be approximately $1.9 billion, $1.1 billion lower than beginning of year guidance primarily reflecting a reduction in the Bakken rig count and deferral of capital in Guyana.

Midstream capital expenditures were $57 million in the first quarter of 2020, down from $127 million in the prior-year quarter which reflected the prior-year acquisition of crude oil, gas and water gathering assets from Summit Midstream Partners.

Source: KeyFacts Energy

KeyFacts Energy: Hess US country profile

* Premium profile information includes; description, overview of assets, current and planned operational activity, capex, local and corporate locations, links to 'Linkedin People', news archive and farm-in opportunities.

KEYFACT Energy

KEYFACT Energy