Serica Energy is a British independent upstream oil and gas company with operations centred on the UK North Sea with a full range of exploration, development and production assets. At the start of 2020 Serica has over £100 million in cash, no debt and limited decommissioning liabilities.

Following the completion of a series of deals at the end of 2018, Serica became a major player in the UKCS, adding to their portfolio a 98% interest in the Bruce field, a 100% interest in the Keith field and a 50% interest in the Rhum field (collectively the ‘BKR’ assets). With these acquisitions, the company's average net production increased from around 2,000 boe/d to over 30,000 boe/d.

Serica also expanded their capabilities by taking over as operator of all three fields and the associated asset infrastructure. In 2019, the company was responsible for operating over 40,000 boe/d of gross production - making them one of the largest independent operators on the UKCS.

Key numbers:

- 4 producing fields

- 30,000 boe/d 2019 production net to Serica

- 41,000 boe/d gross operated gas and liquids

- 62 mmboe net 2P reserves at 01.01.20 >80% of production is gas

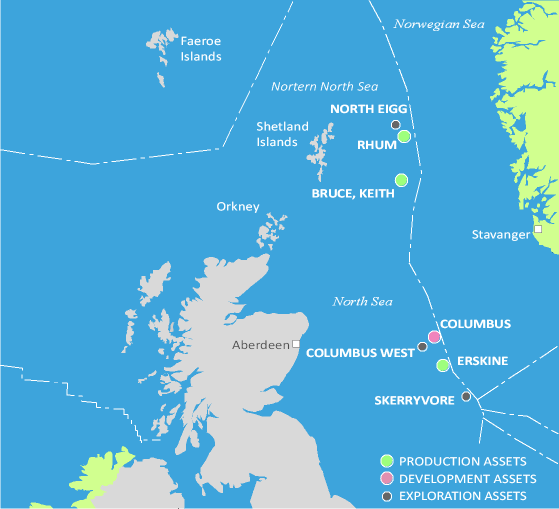

Serica operates the Bruce, Keith and Rhum assets in the UK Northern North Sea.

Serica is also a partner in the producing Erskine field and is the development operator for the Columbus gas-condensate field, both located in the UK Central North Sea.

UK OPERATIONS

Rhum Field

Block 3/29a, Serica 50% and operator

The Rhum field is a gas condensate field producing from two subsea wells, R1 and R2, tied into the Bruce facilities through a 44km pipeline. Rhum production is separated into gas and condensate and exported to St Fergus and Grangemouth respectively along with Bruce and Keith production.

Combined, the wells are capable of producing at rates approaching 30,000 boe/d (gross) of which some 95% is gas.

A third well, R3, requires intervention work before it can be brought on production. The intention remains to carry out the work this year but project execution may be deferred until 2021.

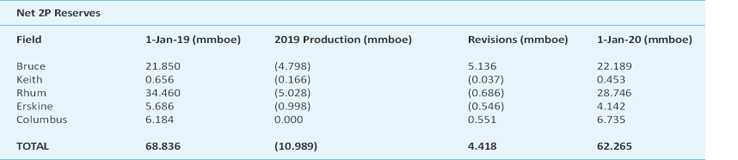

The latest independent estimate of reserves by Lloyd's Register (LR) estimated 2P reserves of 28.7 million boe net to Serica as at 1 January 2020.

Out of round award

In December 2019, Serica Energy (UK) Limited, received an out of round award of a 100% interest in the UK petroleum licence P2501, blocks 3/24c and 3/29c. These are located in the area adjacent to the Serica operated Rhum field. The award contains the HPHT North Eigg and South Eigg prospects and Serica has committed to drilling an exploration well on the North Eigg prospect within 3 years. In the event of a discovery on these blocks, Serica will investigate options for HPHT subsea tie-backs to the Bruce facilities and topsides modifications to ensure a low cost, efficient design to enable early development, maximise recovery and optimise production. Serica anticipates that there will be ample capacity within the Bruce facilities to handle North and South Eigg production.

Bruce Field

Blocks 9/8a, 9/9b and 9/9c, Serica 98% and operator

Serica completed the acquisition of its 98% interest in the Bruce field on 30 November 2018 and took over as operator from BP.

Bruce field production in 2019 averaged in excess of 13,100 boe/d of exported oil and gas net to Serica (2018 proforma – 12,000 boe/d). Production reliability was 93% with a short, planned maintenance period that overlapped the annual Forties Pipeline System integrity testing.

The latest independent report by Lloyd’s Register estimated 2P reserves of 22.2 million boe net to Serica as of 1 January 2020.

Keith Field

Block 9/8a, Serica 100% and operator

Keith is a small oil field produced via one subsea well tied back to the Bruce facilities and requires very little maintenance. Keith produces at a relatively low rate but contributes to oil export from Bruce at minimal additional cost. Average Keith production in 2019 was approximately 450 boe/d (2018 proforma – 800 boe/d). It is intended to keep the well in production as long as economically viable.

The latest independent estimate of reserves by LR estimated 2P reserves of 453,000 boe net to Serica as of 1 January 2020.

Erskine Field

Blocks 23/26a (Area B) and 23/26b (Area B), Serica 18%

Serica holds a non-operated interest in Erskine, a gas condensate field located in the UK Central North Sea. Serica’s co-venturers are Ithaca Energy 50% (operator) and Chrysaor 32%.

The Erskine field is produced through five wells from the Erskine normally unattended installation, transported to Lomond via a multiphase pipeline and processed on the Lomond platform. Condensate is then exported down the Forties Pipeline System via the CATS riser platform at Everest and gas is exported via the CATS pipeline to the terminal at Teesside.

An updated independent audit of the Erskine field by LR confirmed estimated 2P reserves of 4.1 million boe net to Serica as of 1 January 2020.

Columbus Development

Blocks 23/16f and 23/21a, Serica 50% and operator

Serica is Columbus field operator with partners Tailwind Mistral Limited (25%) and Waldorf Production Limited (25%). This gas condensate discovery is located in the Eastern Central Graben, UK Central North Sea and the reservoir is located within the Forties Sandstone.

In October 2018, OGA approved a Field Development Plan (“FDP”) for Columbus, which included an expected peak production of 7,800 gross boe/day.

The Columbus development plan involves tying a single horizontal subsea well into a pipeline being laid between the Arran field (which received development approval at a similar time to Columbus) and the Shearwater platform, both operated by Shell. Arran and Columbus fluids will combine in the new pipeline and be produced together through to the Shearwater processing facilities, making use of an existing riser. The Columbus partners will pay for the tie-in and compensate the Arran owners for some re-routing of the pipeline but will not bear the capital cost of laying a new pipeline to Shearwater. Costs will be recovered by Arran by way of a tariff on production through the pipeline.

North Eigg and South Eigg

Blocks 3/24c and 3/29c, Serica 100% and operator

In December 2019, Serica was awarded the licence containing the North Eigg and South Eigg prospects as part of an out of round application. The work programme is to reprocess seismic and drill an exploration well within the initial three years. The North Eigg prospect has been high-graded for drilling, being clearly visible on 3D seismic data and sharing many similarities with the nearby Rhum field, operated by Serica.

Columbus West

Block 23/21b, Serica 50%, operator Summit Exploration and Production

The Columbus West licence was awarded in the UK 30th Round and lies directly west of Serica’s operated Columbus field. Serica has used its regional understanding to work with its partner to aim to identify potential commercially attractive prospects. During 2019 seismic reprocessing was completed over the licence and technical interpretation of the data carried out to help identify a potential drilling target. The prospects are currently being screened and ranked and there will be a drill or drop decision by the end of the initial term, October 2020.

Skerryvore and Ruvaal

Blocks 30/12c (part), 30/13c (split), 30/17h, 30/18c and 30/19c (part), Serica 20%, operator Parkmead

The Skerryvore and Ruvaal prospects lie in the Central North Sea, 60km south of the Erskine field. Over 500km² of 3D seismic data has been purchased over the licence areas. The seismic is being reprocessed and will then be interpreted and a drill or drop decision made on the prospects by the end of the initial three-year term in September 2021.

A new Competent Person's Report (CPR) extended Bruce Cessation of Production (COP) from 2026 to 2028 and upgraded 2P Reserves to 62.3 mmboe adjusted for 2019 production.

NAMIBIA

Luderitz Basin, Blocks 2512a, 2513a, 2513b & 2612a (part)

Serica 85% (operator), NAMCOR 10%, IEPL 5%

Blocks 2512A, 2513A, 2513B and 2612A (part) lie wholly within the Luderitz Basin and cover an area of 17,384 square kilometres. Serica has an 85% working interest in the blocks and is looking to secure partners to jointly explore what it believes to be a highly prospective frontier basin with world-class potential. Serica’s partners in the licence area are National Petroleum Corporation of Namibia (Pty) Limited (NAMCOR) (10%), and Indigenous Energy (Pty) Limited (5%).

Three large four-way dip-closed structures (prospects A, B and C) have been identified in the blocks with stacked reservoir potential at Lower Cretaceous, Upper Cretaceous and Palaeocene levels, each with mapped closures well in excess of several hundred square kilometres. In addition, further prospects and leads have been identified within canyon - channel and shelf edge plays, with the potential for trapping significant hydrocarbon volumes in stratigraphic pinch-outs.

Serica is in discussion with the Namibia Ministry of Mines and Energy on new licence terms to extend its interest in the Luderitz Basin blocks. It is anticipated that these discussions will be completed in the near term allowing Serica and its partners to progress work on the licence.

During 2019, Serica incorporated recent drilling results offshore Namibia to build on its geological understanding of the region. These results have provided evidence towards a regional seal rock that would trap migrating hydrocarbons, thus benefitting deeper prospects, some of which have been identified in Serica’s licence area. Serica understands that further drilling in Namibia is currently planned by other operators, which will provide more data points and hopefully strengthen the chance of success of Serica’s prospects

CONTACT

Serica Energy plc

48 George Street, London W1U 7DY, United Kingdom

T. 44 (0) 20 7487 7300

Serica Energy

H1 Building, Hill of Rubislaw, Anderson Drive, Aberdeen AB15 6BY

T. 44 (0) 1224 978400

LEADERSHIP

- Mitch Flegg Chief Executive Officer

- Andy Bell VP Finance

- Clara Altobell VP ESG and Business Innovation

- Stephen Lambert VP Commercial

- Mike Killeen VP Operations

- Fergus Jenkins VP Projects

- Carol Stewart BKR Business Manager

- Danny Fewkes Group Treasurer

Link to Serica Energy UK country profile

KEYFACT Energy

KEYFACT Energy