Trinity Exploration & Production, the AIM listed independent E&P company focused on Trinidad and Tobago, today provides an update on its operations for the three-month period ended 30 June 2020.

Trinity has continued to combine growing production levels, a low operating break-even and a technically advanced operating capability with a robust financial position, putting the Company in an exceptional position to contemplate new investment opportunities.

Significantly, production levels were maintained during Q2 2020 with production volumes averaging 3,272 bopd, yielding a H1 2020 average of 3,282 bopd. The Group's unaudited cash balances increased to US$19.7 million as at 30 June 2020 (US$13.8 million (audited) as at 31 December 2019).

The Company reduced its pre-hedge income operating break-even (revenues less royalties, opex and G&A) by over 15% quarter-on-quarter to US$22.6/bbl (unaudited) (Q1 2020: US$26.7/bbl (unaudited)). After hedging income, this translates into an effective operating break-even of $21.6/bbl indicating that the Company is well on track to meet its target operating break-even (inclusive of hedging income) of US$20.5/bbl for FY 2020.

Q2 2020 Operational Highlights

· 8.5 % year-on-year increase in Group average production volumes to 3,272 bopd for the second quarter (Q2 2019: 2,996 bopd) without any new wells being drilled, representing broadly flat quarter-on-quarter production (Q1 2020: 3,291 bopd).

· H1 2020 average production volumes of 3,282 bopd represent a year-on-year increase of 9.1% (H1 2019 3,008 bopd).

· 3 recompletions ("RCPs") (Q1 2020: 3) and 17 workovers (Q1 2020: 39) were completed during the period, with swabbing continuing across all onshore assets.

· Successful application of Weatherford's Supervisory, Control and Data Acquisition ("SCADA") with improved quantitative and qualitative performance from the wells

o Improved problem diagnosis

o More accurate operational responses to issues

o Better understanding of system performance as related to technical design

o Extending run-life

o Greater optimisation of wells.

· Production volumes for the remainder of 2020 will depend on oil price and general market conditions supporting the economic case for the resumption of drilling activity.

· Even if the prevailing oil price environment does not support the case for a resumption of drilling in the near term, net average production for 2020 is still expected to be in the range of 3,100 - 3,300 bopd (2019: 3,007 bopd).

Q2 2020 Financial Highlights

· Average realisation of US$26.4/bbl for Q2 (Q1 2020: US$46.3/bbl) yielding a H1 2020 average of US$36.3/bbl (H1 2019: US$59.1/bbl). As a result, no Supplemental Petroleum Taxes (" SPT ") will be payable with respect to H1 2020 production.

· Cash balance of US$ 19.7 million (unaudited) as at 30 June 2020 (31 December 2019: US$13.8 million, audited). The H1 2020 cash balance reflects:

o Cash outflows for Q4 2019 taxes (including SPT) of c.US$2.2 million, as well as annual payments (such as insurance and licence obligations) of US$0.7 million and capex of c. US$2.5m during H1 2020.

o Cash inflows of US$2.7 million (from the drawdown of the CIBC First Caribbean working capital facility), US$2.8 million (from the sale of the recently received VAT Bonds) and net hedge income of US$0.8 million received during H1 2020.

· Robust production levels combined with strict cost controls resulted in an average operating break-even of US$ 22.6/bbl (unaudited) for Q2 2020 versus Q1 2020 at US$26.7/bbl (unaudited) and compared to US$26.0/bbl for Q2 2019.

· The downward trends in operating break-even continues, with the June 2020 level of US$21.6/bbl (post hedging income: US$19.8/bbl).

· The Company is on track to meet its target for average operating break-even (inclusive of hedging income) of US$ 20.5/bbl for FY 2020.

Operations Update

The Company's field operations have not, to date, been negatively impacted by COVID-19, but we continue to monitor the situation and have put further appropriate measures in place (including temperature checks) and will continue to adapt as and when required.

The Company's continued focus on managing production decline has resulted in production levels being maintained at close to recent highs even in the absence of new wells being drilled and a reduced number of RCPs being undertaken. Protecting past investment is a key priority and ensures that rates of return are maintained despite the dramatic reduction in the oil price.

The extent and timing of the resumption of the onshore drilling programme will be dependent on the prevailing economic environment during the remainder of this year. In the meantime, the sub-surface team has been tasked with prioritising the identification of high angle well ("HAW") drilling locations and the Company will continue to roll out further SCADA platforms on selected existing wells.

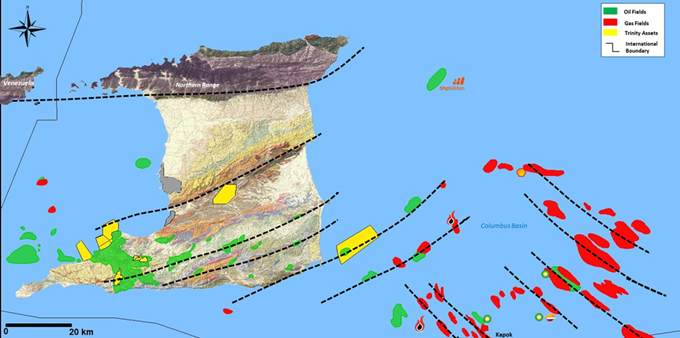

On the Company's east coast Galeota licence, dialogue continues with both Heritage Petroleum Company Limited (Trinity's partner) and The Ministry of Energy and Energy Industries (Trinity's regulator) in moving both the Trintes Field area and the TGAL field development forward. The Environmental Impact Assessment ("EIA") study commenced in February with all dry season data collection having subsequently been completed and wet season data collection is due to commence shortly. Work on building the dynamic reservoir model continues on the TGAL development. This important work assists in optimal platform and well placement and in better understanding the best strategy to drain the maximum amount of reserves with the minimum number of wells.

New Business: Pursuing Scale

Trinity's production model delivers free cash generation across a broad range of oil prices. This is underpinned by the Company's drive to reduce costs and maintain industry leading operating break-even levels. Furthermore, the Company's financial strength compared to many of its peers, where break-evens are higher and finances are potentially more constrained, means that it is well placed to take advantage of commercial opportunities as and when they arise.

Outlook

The focus remains on tight cost controls and maintaining profitable production in the current low oil price environment thereby preserving balance sheet strength. Progress towards the low target break-even highlights the strength of the Company's operating model. The Company's strong production base combined with its ever increasing use of analytics provides a solid base for continued organic growth. In addition, asset acquisitions and partnerships are another possible source of growth, offering the potential to increase scale, drive economies and thereby improve operating break-evens and cash generation to further enhance shareholder value.

Bruce Dingwall CBE, Executive Chairman of Trinity, commented:

"Sustaining production levels under the current exceptional circumstances is an incredible achievement and ought not to be underestimated. To maintain higher production levels with very limited financial investment and the added restrictions of COVID-19-secure practices is a testament to the strength of the business and ultimately the intense efforts of the team.

"It is this extreme, and unexpected, stress testing event that has given the Company the increased confidence and ability to focus on scaling the business. When one considers our financial discipline, balance sheet strength and credibility, as well as our differentiated operating model and corporate ambition, we are very well placed to grow our business both organically and via external opportunities.

"I must again thank all off our staff for their unstinting dedication to their jobs and responsibilities and to the supply chain and their employees for supporting our operations through this extraordinary period of both a challenge and now an opportunity."

KeyFacts Energy: Trinity Trinidad and Tobago country profile

KEYFACT Energy

KEYFACT Energy