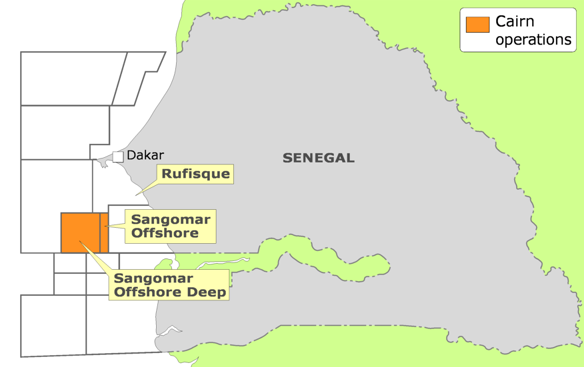

Cairn has entered into an agreement to sell to LUKOIL its entire 40 per cent interest in the Rufisque Offshore, Sangomar Offshore and Sangomar Deep Offshore (RSSD) Contract Area, including the Sangomar development, offshore Senegal, for a cash consideration of up to US$400 million plus reimbursement of development capital expenditure incurred since 1st January 2020. Following Completion, Cairn intends to return at least US$250m to shareholders.

Cairn assets in Senegal (Map source: KeyFacts Energy)

The Transaction, which follows a comprehensive sales process, is consistent with Cairn’s disciplined approach to portfolio management and capital allocation, and its long-term strategy to return capital to shareholders. It will also enhance the Group’s financial flexibility to sustain and grow a balanced and robust portfolio during the current challenging and uncertain oil market conditions.

Transaction Highlights

- Cairn to sell its entire 40 per cent interest in the RSSD assets to LUKOIL with effective date of 1st January 2020, subject to required JV partner and government of Senegal consents;

- Completion currently expected in Q4 2020;

- Cash consideration payable on Completion of US$300m plus working capital adjustments including reimbursement of development capital expenditure incurred since 1st January 2020 (Cairn’s net capex guidance for Sangomar in 2020 is US$330m);

- Further contingent consideration of up to US$100m, dependent on the timing of first oil and the average Brent oil price during the first six months of production;

- Realises value and reduces concentration of development risk, financing risk and the need for significant capital expenditure over four years;

- Further strengthens Cairn’s balance sheet and provides flexibility to invest in and grow the business; and

- Intention to provide a substantial and certain return of capital to shareholders of at least US$250m by special dividend following Completion, consistent with Cairn’s approach to capital allocation.

Simon Thomson, Chief Executive of Cairn said:

“We are proud of what Cairn has achieved in Senegal. Our discoveries were the country’s first deep-water wells and opened up a new basin play on the Atlantic Margin. What’s more, they successfully laid the foundations for Senegal’s first oil and gas development, which will deliver enduring benefits to its people.

With a strong balance sheet, low breakeven production and limited capital commitments, Cairn will have enhanced financial flexibility to invest in and grow the business whilst always remaining committed to returning excess cash to shareholders.

The planned special dividend from the sale of the Sangomar asset reflects Cairn’s long-standing strict capital allocation strategy of active portfolio management and returning cash to shareholders.

We will work closely with the Government of Senegal, LUKOIL and joint venture partners to ensure the transaction is completed as soon as possible.”

KeyFacts Energy: LUKOIL Overseas Senegal country profile l KeyFacts Energy: New Kid on the Block

KEYFACT Energy

KEYFACT Energy