Several large and small independent US oil and gas producers have filed for bankruptcy this year as their debt burden peaked and hopes for cash flow recovery plunged, with WTI crude oil prices still remaining in the low $40s. At the same time, the distressed market has created opportunities for both institutional investors and supermajors with stabilized equity prices to buy into discounted shale. This commentary looks at Chapter 11 filings and US shale merger and acquisition activity, further diving into the debt situation of the shale producers.

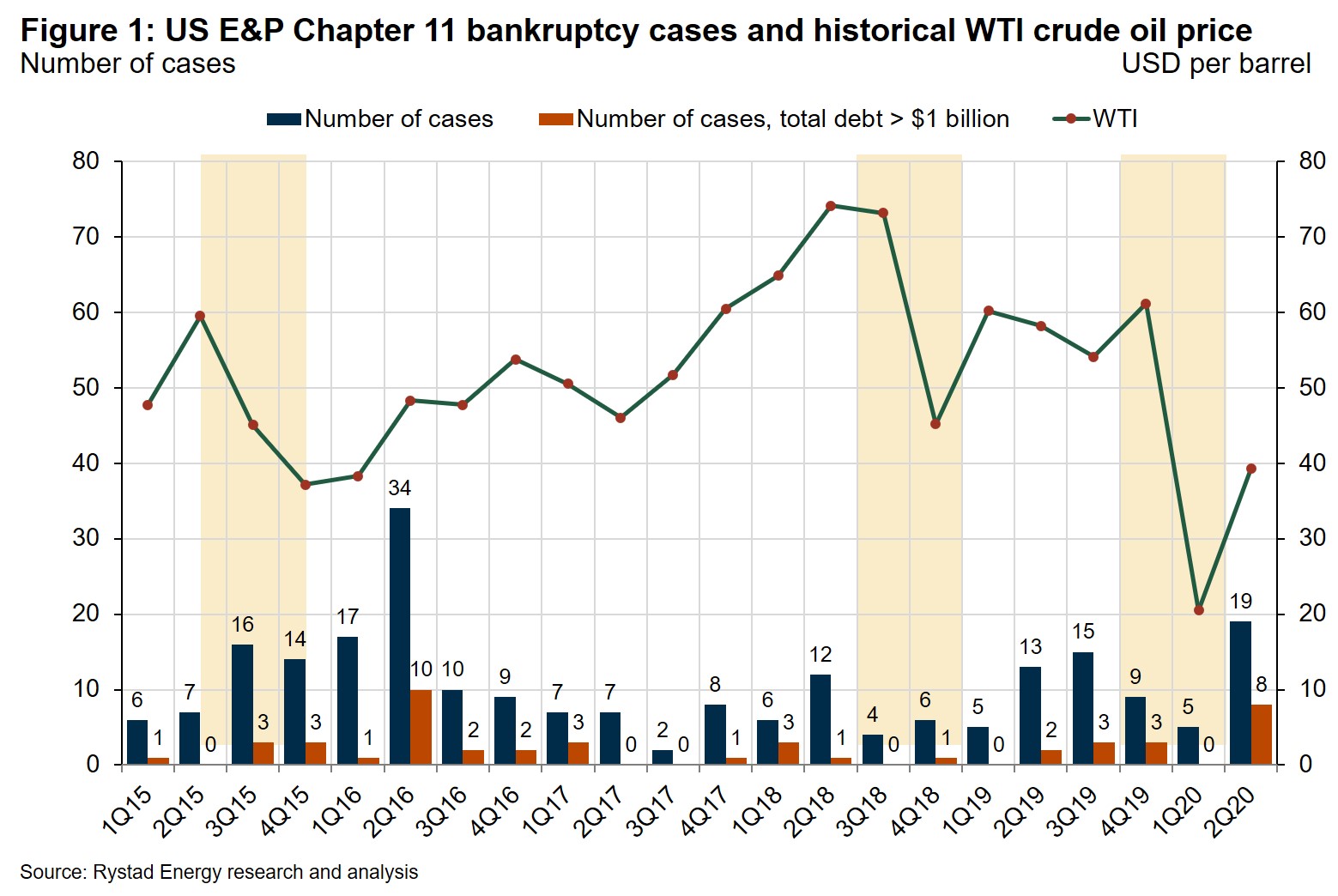

The number of Chapter 11 cases for US E&P companies jumped to a four-year high in 2Q20, both in terms of the overall number of cases and in cases filed by companies with at least $1 billion in total debt (Figure 1). Both in 2Q20 and 2Q16 the number of cases increased as WTI prices dropped below $40, causing operators with higher breakeven prices to struggle to service their debt. Some of the operators that were on the edge but survived without filing for bankruptcy in 2016 were not able to avoid it this time around. The largest companies that have filed for Chapter 11 in 2020 include Chesapeake Energy (debt: $9.2 billion), Ultra Petroleum (debt: $5.5 billion), Whiting Petroleum (debt: $3.6 billion), Denbury Resources (debt: $2.1 billion) and Extraction Oil & Gas (debt: $1.9 billion).

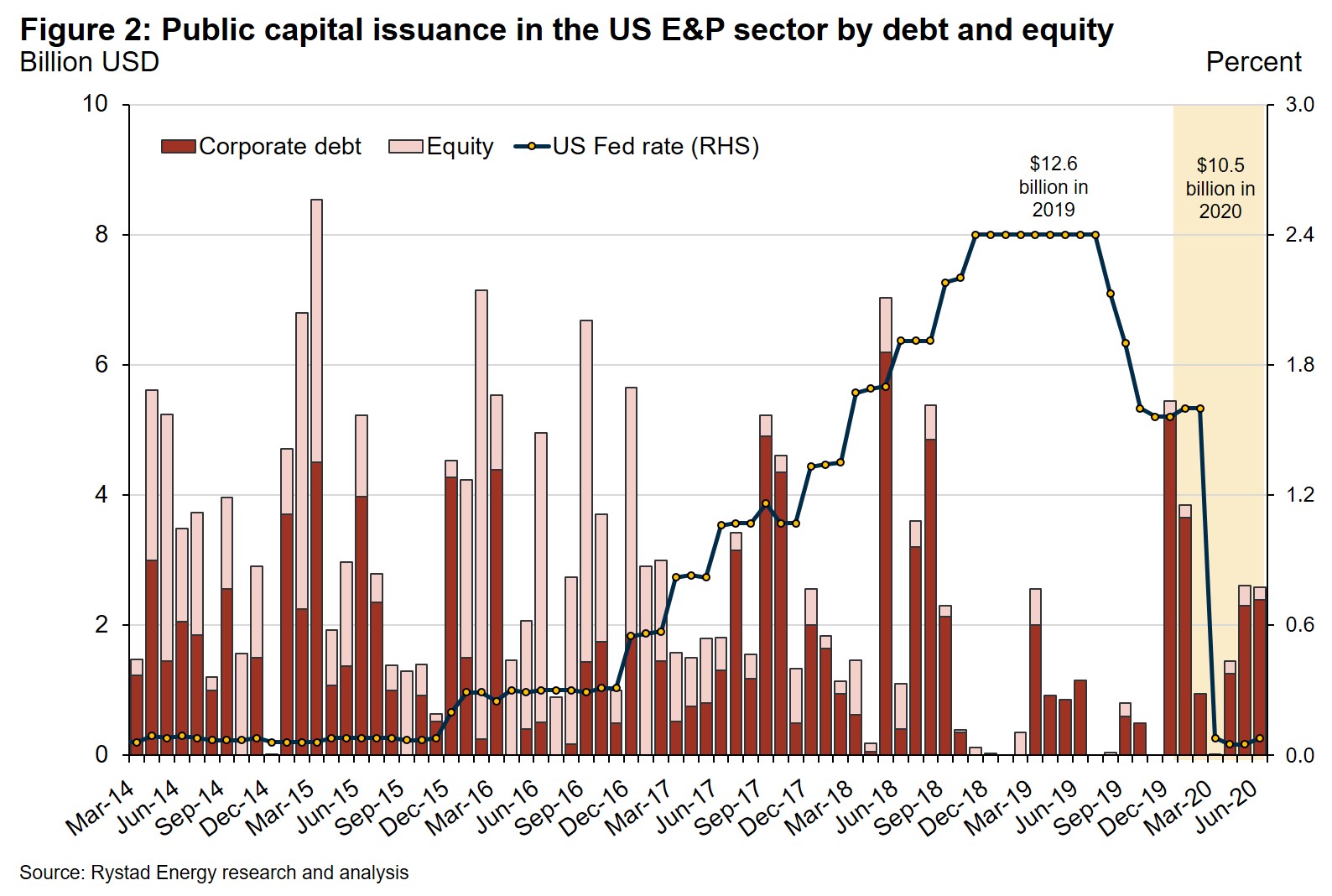

External capital raised by the US E&P industry was at an all-time low of $12.6 billion in 2019, compared to a $37.7 billion annual average seen since 2014, despite the strong December addition of $5.2 billion in debt (Figure 2). So far in 2020 the industry has already issued $10.5 billion, mostly driven by EQT, Laredo Petroleum, Parsley Energy, WPX Energy, Diamondback Energy and Pioneer Natural Resources. We expect 2020 debt issuance to surpass last year already in 3Q20. Capital raising remains focused on debt refinancing and drilling capex support.

So far this year the US onshore market has seen 14 M&A deals, with only one of them worth more than $1 billion (Figure 3). By comparison we saw six deals exceeding $1 billion in the first seven months last year and nine for the whole of 2019, all of which were company mergers. The largest deal so far this year is Chevron’s announced acquisition of Noble Energy in mid-July for a total market enterprise value of $13 billion when including Noble’s debt. The deal announcement came about a year after Chevron and Occidental’s bidding war over Anadarko for an astonishing $57 billion, where Occidental came out on top. Another interesting deal was announced in May, when National Fuel Gas (NFG) announced plans to acquire Shell’s Appalachian acreage for $541 million.

Given the uncertainty and the low commodity prices in the US market so far in 2020, one may speculate if this is a perfect time for asset-specific acquisitions, especially in the oil basins at the lowest cost we may ever see. As many of the smaller operators are struggling, robust companies can easily get a good price when expanding their portfolios.

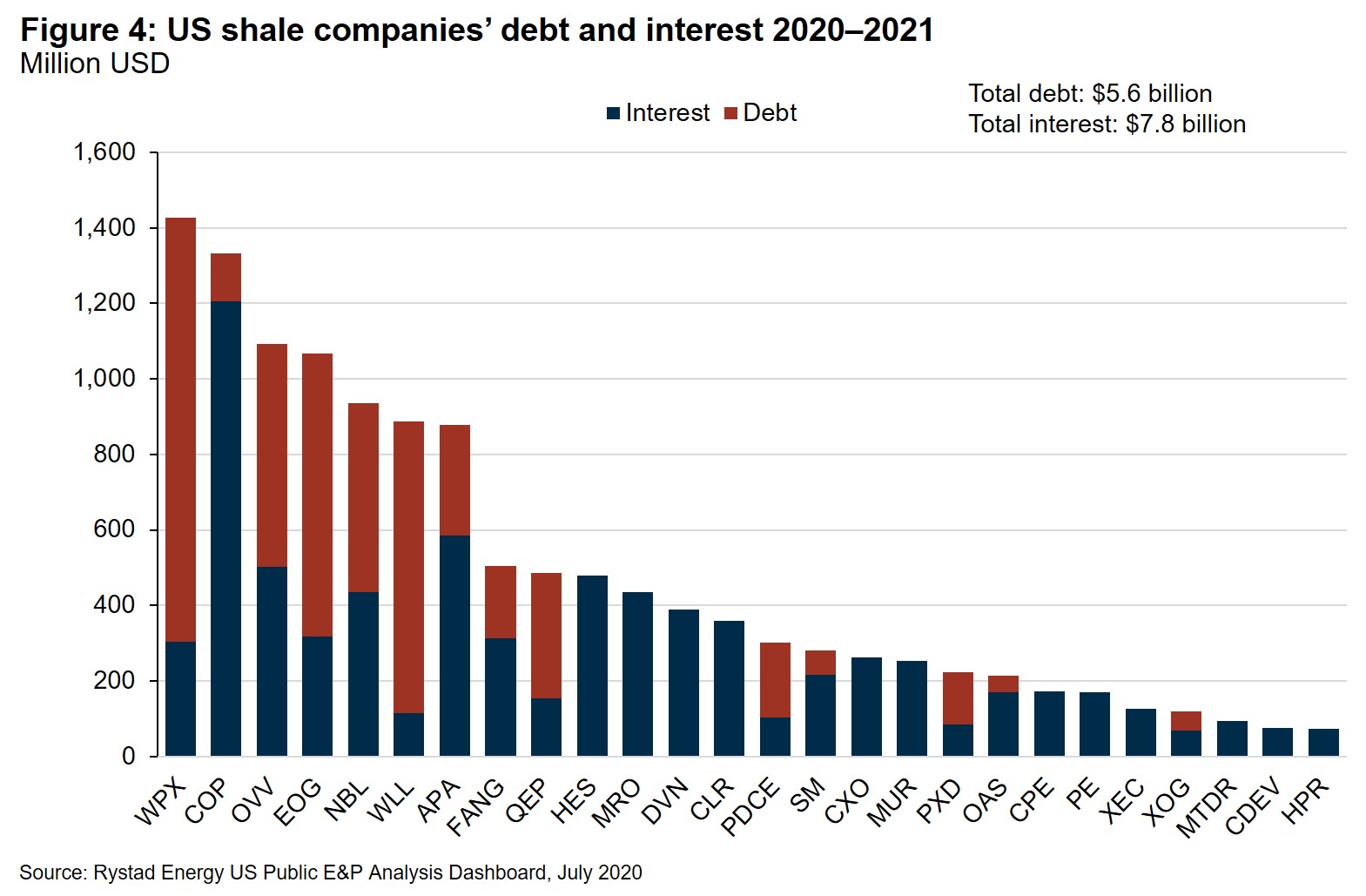

WPX Energy, affected by its Felix acquisition in January 2020, stands out as the operator with the largest debt and interest burden for the coming year and a half (Figure 4). The next four companies significantly surpass WPX in size and asset base. It is important to note that WPX issued an additional $0.5 billion in corporate bonds in June to fund a tender offer across three series of outstanding senior notes totaling $1.126 billion, including 6% 2022s, 8.25% 2023s and 5.25% 2024s. Coupled with an earlier issuance of $0.9 billion in January, WPX is expected to have close to zero in debt maturity for 2020-2021 in the coming reporting. ConocoPhillips (COP), the largest US independent producer, expectedly has the largest interest burden, amounting to $0.8 billion in 2021 alone. At this point the peer group stands at $5.6 billion in debt payments and $7.8 in interest.

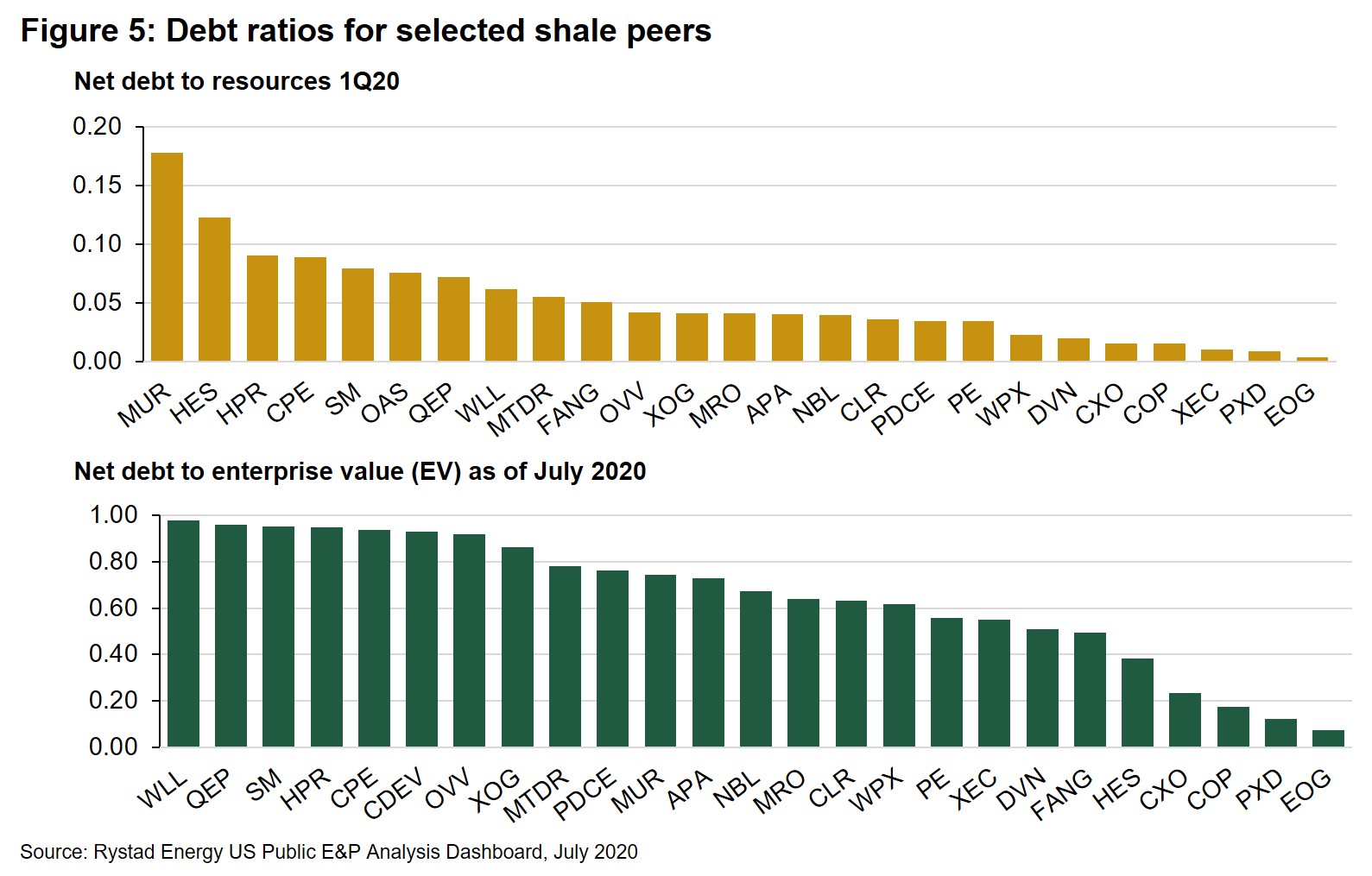

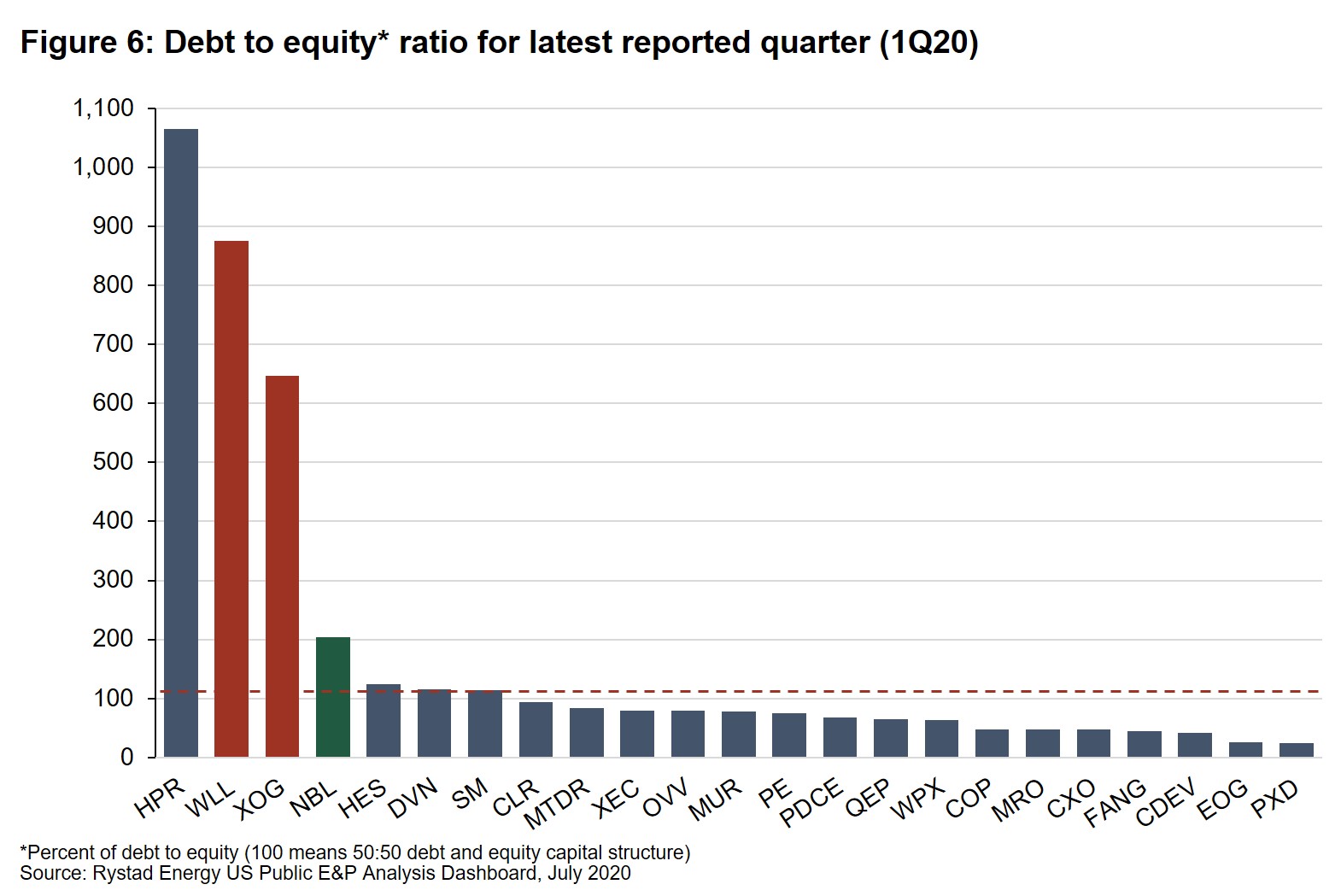

Despite their high interest and debt numbers for 2020 and 2021, both WPX and ConocoPhillips are among the operators with the lowest net debt to resources and net debt to EV ratios, which provide more comparable indicators for debt leverage assessment (Figure 5). Furthermore, looking at 1Q20 debt-to-equity ratios (Figure 6), the numbers clearly match the latest bankruptcy and acquisition announcements. Whiting Petroleum (WLL) and Extraction Oil & Gas (XOG) have filed for bankruptcy, while Noble Energy (NBL) has been acquired by Chevron as a company with largely delayed maturities and discounted equity price at the moment of acquisition. The debt-to-equity ratio of HighPoint Resources (HPR) jumped to above 1,000 in 1Q20 from 73 in 4Q19 as the company’s stock price dropped to below $1, causing its total equity value to plunge from $1 billion to $0.07 billion. Looking at the other peers on the chart, one can speculate which operators could be attractive targets for the supermajors and which could be better merger alternatives in the coming years as the industry attracts more capital.

KeyFacts Energy Industry Directory: Rystad Energy

KEYFACT Energy

KEYFACT Energy