Wood Mackenzie’s latest report shows that the power generation sector in Asia Pacific could attract US$1.5 trillion worth of investments over the decade ending 2030.

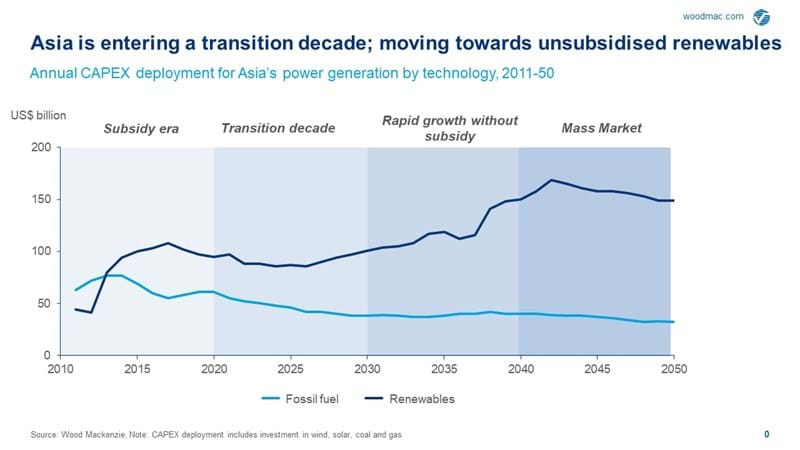

Solar and wind represent 66% or US$1 trillion investment opportunity in Asia Pacific through 2030, while fossil fuels, mainly coal and gas, make up the remaining US$500 billion. Investments in renewables have overtaken fossil fuel power since 2013.

Wood Mackenzie senior analyst Rishab Shrestha said:

“The next decade will see gas/coal investment split at 40/60 but the share of coal is falling and beyond 2030 gas will contribute 70% with coal falling to 30%.

“Traditionally, energy security and availability of low-cost coal are key drivers of coal investment in Asia. However, investment sentiment towards coal is waning as economies strive for a more sustainable and greener future.

“Coal investment will fall from its peak of US$57 billion in 2013 to US$18 billion by the end of the decade.”

The region is also expected to add over 170 gigawatts (GW) of new power capacity annually in the next decade. The pace of additions will accelerate beyond 2030.

Shrestha said:

“We should see a slight slow-down in capacity additions in the next five years due to coronavirus related sluggish demand. This should pick up from 2026 onwards.”

However, Wood Mackenzie research director Alex Whitworth cautioned that there are increasing headwinds and risks for renewables investments.

He said:

“The Asia Pacific region has entered a transition decade where wind and solar investment is expected to decline by 20% by 2025 from its peak in 2017. Generous government subsidies during the high-cost renewable era were key drivers of the previous growth period.

“In the next five years subsidies are being cut, grid constraints are increasing, and renewables investment is falling in key markets amidst more exposure to market forces. But even while some markets are hit hard, others develop rapidly.”

Australia has been a leader in renewables but is facing a major drop of 67% in investments in the next five years. Curtailment, transmission constraints and sustained low capture prices are key challenges as Australia’s share of variable renewable energy in generation (VRE), which includes wind and solar, hits 21% this year – the highest in Asia Pacific.

During the transition decade to 2030 the VRE share of generation is a key metric that impacts power markets. Renewables investments are growing rapidly in regions with low VRE shares such as Southeast Asia, Northeast Asia and coastal China.

By 2030 the share of wind and solar in the Asia Pacific power generation will more than double to 17% with over 51 regional markets out of 81 modelled exceeding 10% VRE.

Gas and dispatchable power will continue to play a key role in providing flexibility to power systems. Energy storage capacity will more than double during the transition decade to 9% of peak load, with pumped hydro storage dominating, as battery storage rapidly develops.

Whitworth said:

“Post 2030, we expect major acceleration in renewables investments driven by improvement in technology, lower costs and clarity in policies. In particular, we expect renewables to be competitive with new coal plants by 2030 setting the stage for a new era of subsidy-free growth.”

KeyFacts Energy Industry Directory: Wood Mackenzie

KEYFACT Energy

KEYFACT Energy