Angus Energy announces that, with the support of Saltfleetby Energy Limited ("SEL"), its 49% partner in the Saltfleetby Gas Field, the Company has engaged Gneiss Energy Limited, a strategic and financial advisory firm operating in the energy and natural resources sectors, to raise up to £12 million through the issue of a senior secured debt facility to assist in funding the redevelopment of the Field.

In order to support the Proposed Debt Funding, Angus announces that it is today carrying out an equity fundraising to raise approximately £900,000, before expenses, through the issue of c.100,000,000 Ordinary Shares at a price of 0.9 pence per share. This will form part of a working capital contingency fund that is normally required by debt providers.

W.H. Ireland Limited is acting as broker in relation the Placing. A placing agreement has been entered into today between the Company and the Broker in connection with the Placing.

The Proposed Debt Funding

The Company is seeking to raise up to £12m through the issue of a senior secured debt facility which will be secured, inter alia, on 100% of the Company's and SEL's working interest in the Field. It is the intention that the cash interest and repayments under the Proposed Debt Funding are expected to be serviced by net cash flows from 100% of the Field revenues generated immediately from the commencement of commercial gas sales, i.e. including those attributable to our partner Saltfleetby Energy Limited. As such, the Proposed Debt Funding is to include joint and several obligations of both Saltfleetby Energy Limited and the Angus Energy Group.

The proceeds of the Proposed Debt Funding will be used as to:

- £1.8 million toward pipeline installation and connection to the National Transmission System of which £1.1 million has been spent to date;

- £5.7 million toward processing facilities;

- £1.6 million toward site preparation, planning and contingencies;

- £2.4 million toward a reserve for drilling the planned 2021 sidetrack of an existing well on the Field; and

- £1.5 million toward an abandonment reserve for the Field.

Setting aside payments made from SEL to the Company, the Competent Persons Report ("CPR") published in March 2020 showed 2020 gross capex of £3.8 m being in part £2.1 m for the pipeline spur (£0.9m) and National Grid connection costs (£1.2m) which to date has remained below budget. The balance of £1.7m of capital expenditure estimates for the process plant has proved to be inadequate even allowing for £1.0 m of process equipment leasing costs already included within the CPR opex estimates.

The above £3.8 m when added to the CPR leasing opex of £1m should be set against the above final estimates of £8.1 m resulting in an increase of £3.3 million which we will be sharing 51%/49% with SEL. Thus we estimate the downward impact on the P90 (1P) Field Valuation will be a maximum of approximately £1.7m or a 10% from £16.7 m to £15 m being the most pessimistic case (assuming all other inputs remain unchanged).

The principal cause of the increase in equipment costs is the ramification of EU safety regulations enshrined in the ATEX Directive. This serves to exclude the great majority of North American API certified high pressure gas equipment from use in Europe without extensive re-engineering and re-certification. Until relatively recently, Angus had hoped to overcome this regulatory hurdle but after consulting a range of experienced suppliers, the Company has concluded that the cost is prohibitive. In addition, the equipment costs set out above are reflective of the Company and SEL's decision to purchase all of the Field equipment itself rather than proceeding with a mix of leasing and purchasing.

SEL have agreed that the given the Field costs absorbed to date by Angus, advance work done on abandonment of wells 1, 3 and 6, and assistance in providing (as necessary) equity kickers to the proposed debt funding coupon, all costs going forward should be borne out of the facility including residual spend of £0.7 m of connection costs related to the pipeline and National Grid. This will include expenditure on the side-track originally expected to have been funded out of field revenues.

The terms of the Proposed Debt Funding will be communicated to shareholders when definitive documents are signed alongside any consequential alterations to our timetable.

Use of Placing Proceeds

Whilst the Company has some small immediate commitments for capital expenditure in obtaining a Cement Bond Log on the potential water injector well at Brockham and in abandonment work of SF06 at Saltfleetby, the principal aim of the facility is to provide a working capital buffer normally expected by debt investors.

George Lucan, Managing Director, commented:

''We believe this equity and prospective debt capital raise represents a more comprehensive, cost effective and simpler arrangement than a patchwork of leasing and hire purchase agreements with a multitude of suppliers.

Even allowing for the revised capex, the Company's reworking of the CPR calculations show the Company's share of the Field's post tax revenues net of costs would be of the order of £20m on P90, £33 m on P50 and £60m on a P10 valuation.

We note that to date the Company's share price reflects only a fraction of the estimated CPR valuation of the Field with no value attributed to the Company's other Licences at all. We believe much of this discount reflects uncertainty about the Company's capital structure which, given a successful conclusion to the debt funding, should be settled by today's announcement.

Of particular comfort to shareholders will be the provision for next year's capital expenditure on the Saltfleetby side-track, which is intended to accelerate recoveries from the Field, as well as further demonstrative moves on abandonment reserving. Whilst the loan financing is not underwritten, we remain confident of completing the debt placing within a timeframe which should allow us to begin commissioning in Q1 2021."

SALTFLEETBY GAS FIELD

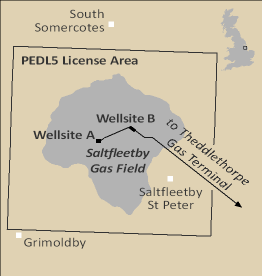

- Licence: PEDL005 (Saltfleetby)

- Licence Area: 91.8km²

- Location: Lincolnshire

- Operator: Angus Energy

- Angus Interest: 51%

- Partners: Saltfleetby Energy 49%

- Wells: SF2, SF4, SF5, SF6, SF7, SF8

The Saltfleetby Gas Field is located onshore UK in licence PEDL005, East Lincolnshire. The field was discovered in 1996 and produced gas from both the Westphalian Sandstones and Namurian reservoirs and was, upon discovery, the largest onshore gas field in the UK with a GIIP of 114 BCF. Production began in 1999 at rates exceeding 50 MMScf per day and produced gas, water, and condesnate was piped via a 10” pipeline to the nearby Theddlethorpe Gas Terminal (TGT) where it was processed and sent into the National Grid. Eight wells and several sidetracks have been drilled on the site.

In 2017, TGT was shut down leaving the field stranded with nowhere to process the produced gas and no direct export route. Angus Energy acquired a 51% interest and operatorship in the field in late 2019/early 2020 and intends to continue production from the field following successful reconnection to the National Grid.

The keys parts of the project are to install processing facilities on the existing Saltfleetby site to ensure gas is at the required pressure, temperature, and specification to be sent to the National Grid, and to install a short export pipeline extension of some 750m to connect the field directly to the National Transmission System. Work is underway to complete these projects with the aim to bring the field onstream in early 2021.

In August 2020, Angus Energy entered into an off-take agreement for the entire production from the Saltfleetby Gas Field with Shell Energy Europe.

KeyFacts Energy: Angus Energy UK country profile

KEYFACT Energy

KEYFACT Energy