The following is a snap shot review of new country entrants covering oil and gas and renewable energy companies since January this year.

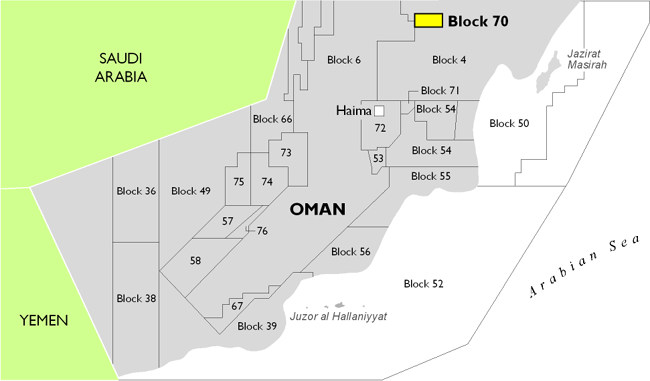

Maha Energy l Oman

In September 2020, Maha Energy reported that the company will be awarded a new exploration block by the Ministry of Energy and Minerals of the Sultanate of Oman. Block 70 is an onshore block that includes the shallow undeveloped Mafraq heavy oil field. The Block is located in the middle of the prolific and oil producing Ghaba Salt Basin in the central part of Oman. Maha will (through a wholly owned subsidiary) be the operator of the Block and hold a 100% working interest. The entry into Oman marks a milestone for the Company’s diversification strategy.

The initial work commitments during the first period include geological studies, seismic reprocessing and well commitments.

Iberdrola l Japan

Iberdrola is targeting the Japanese market as a new platform for growth in renewable energy, specifically in the field of offshore wind. The company has reached an agreement with Macquarie's Green Investment Group to acquire 100% of the local developer Acacia Renewables.

Acacia Renewables currently has two offshore wind farms under development, with a combined capacity of up to 1.2 GW, which could be operational by 2028. It also has four other projects in its pipeline, with a total capacity of 2.1 GW. Iberdrola will hold an equal share in the six projects alongside GIG, and the partners will develop the portfolio.

The operation is in line with the company's strategy, allowing Iberdrola to position itself in the early development stage of Japan's offshore wind market, which has strong growth potential. The deal gives Iberdrola access to a diversified project pipeline, located in different areas of the southwest of the country, in an optimal manner for the auctions announced by the Japanese government.

Total l South Korea

In September 2020, Total and Macquarie’s Green Investment Group (GIG) concluded a 50/50 partnership to develop a portfolio of 5 large floating offshore wind projects in South Korea with a potential cumulated capacity of more than 2 gigawatts (GW).

Located off the Eastern and Southern coasts of the country (Ulsan and South Jeolla Provinces), the projects have commenced on-site comprehensive wind data collection campaign. The partners aim to launch construction of the first project of around 500 megawatts by end 2023.

“Our entry in the floating offshore wind segment in South Korea is in line with Total’s strategy to profitably develop renewable energy worldwide and contribute to our net zero ambition.” said Patrick Pouyanné, Chairman & CEO of Total.

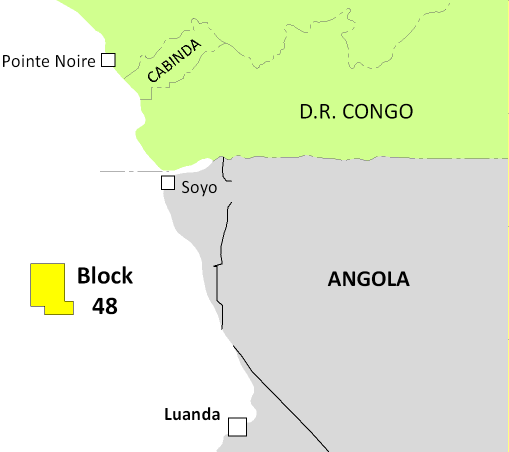

Qatar Petroleum l Angola

In August 2020, Qatar Petroleum entered into a farm-in agreement with Sonangol and Total to acquire a 30% participating interest in Block 48, located in the ultra-deep waters offshore Angola.

His Excellency Mr. Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of Qatar Petroleum, said,

“Continuing on our journey to build a world-class exploration portfolio, by securing interests in promising exploration blocks in diverse geographies, we are pleased to be part of this exciting ultra-deep water opportunity in Angola, a leading oil and gas producing country.”

UK Oil & Gas l Turkey

In July 2020, UK Oil & Gas signed a binding heads of agreement with Aladdin Middle East Ltd ("AME") to take a 50% non-operated working interest in the 305 km² Resan Licence. UKOG will take an active technical role in a 5-well oil appraisal and step-out exploration drilling programme, which, Covid and weather permitting, is expected to commence this year.

The first commitment well, currently planned to appraise and flow test the Basur oil discovery, must commence drilling before 27 June 2021. Drilling and seismic are therefore expected to commence before the end of this year, Covid, weather and Turkish governmental transaction approval permitting.

Talon Petroleum l Australia

In July 2020, Strike Energy announced agreed terms with Talon Petroleum for the acquisition by Talon of a 45% nonoperated interest in Walyering (EP447) in Australia's Perth Basin and formation of an unincorporated Joint Venture for the appraisal and, if warranted, development of Walyering.

On completion of the farm-out, the working interests in Walyering (EP447) will be Strike 55% and Talon 45%. Strike will remain operator of the permit and of the Joint Venture.

Walyering is strategically advantaged in its location being situated between WA’s two major gas transmission lines and with gas that flowed from Walyering-1 only measuring 1% CO₂ and flowing at 13.5mmscf/d. Furthermore, major industrial gas users are located in the immediate area, who have known uses for both the gas and condensate streams locally. Both of the above translates into a potentially very low cost and fast paced development which would avoid the need for significant infrastructure.

Trident Energy l Brazil

In July 2020, Trident Energy closed the acquisition of the Pampo and Enchova clusters offshore Brazil.

This acquisition marks the entry of Trident Energy in Brazil and is in line with its strategy to acquire and operate large mid-life assets globally.

This is a major milestone for Trident Energy, after the successful takeover of the Ceiba & Okume fields in Equatorial Guinea in 2017. While adding another world class asset to its portfolio, Trident Energy’s international growth will bring many new exciting opportunities.

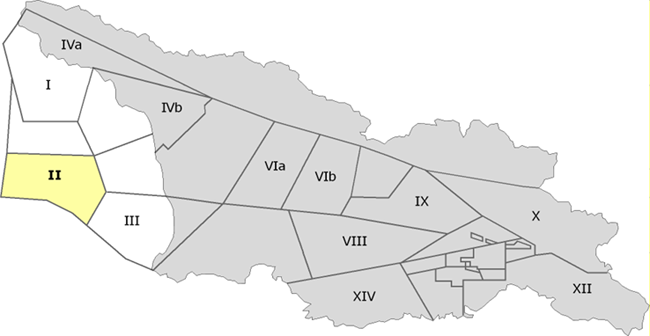

OMV Petrom l Georgia

In June 2020, OMV Petrom was selected as the winner of the open international tender held by the Ministry of Economy and Sustainable Development of Georgia for the Offshore Block II.

The block will be formally awarded only if negotiation of a Production Sharing Contract is successfully finalized. If so, OMV Petrom will obtain the rights to conduct oil and gas exploration activities in Block II, located on the shelf and within the economic zone of the Georgian offshore Black Sea.

OMV Petrom will carry out two- and three-dimensional seismic exploration works and in the event of finding the appropriate reserves, it will start drilling operations.

Iberdrola l Sweden

In June 2020, Iberdrola agreed a deal to take “majority acquisitions” in the projects with the renewables company Svea Vind Offshore AB (SVO) for the future development of up to 9GW of offshore wind energy capacity in Sweden.

Eight projects in total are in various stages of development, and are expected to begin operations from 2029 onwards. They are grouped around two geographical clusters: Gavle (six wind farms with a total of 5.1 GW) and Oxelosund (two offshore wind farms with a combined capacity of 3.9 GW).

The framework agreement will allow Iberdrola in the future to take a majority stake in each of the offshore projects being developed.

Renaissance Oil l Botswana

In June 2020, Renaissance Oil entered into a binding letter agreement to acquire an option for a 50% working interest, in all rights from surface to basement, in a large Petroleum Licence, comprising 2.45 million acres in the Kavango sedimentary basin, in Botswana, Africa.

“The option will provide Renaissance with an important and potentially high impact oil and gas play, through the opening of the Kavango basin, a previously unrecognized, deep sedimentary basin in northwestern Botswana and northeastern Namibia. Botswana is considered a stable, industry friendly jurisdiction which offers some of the most attractive fiscal terms worldwide. This low cost three year option provides excellent value for Renaissance shareholders,” said Ian Telfer, director of Renaissance.

BPC l Uruguay

In June 2020, BPC was the successful applicant for the award of an exploration licence offshore Uruguay by the Uruguayan national regulatory agency, ANCAP. This follows a period in which BPC's technical and operational credentials were first evaluated by ANCAP and BPC was approved as a qualified offshore operator, and thereafter BPC submitted an application for the AREA OFF-1 block.

The OFF-1 licence provides for an initial four-year exploration period, during which time BPC will reprocess approximately 2,000 kilometres of legacy 2D seismic and undertake a number of new geotechnical studies. The Company expects that the cost of the work program in the initial period will consist of approx. US$200,000 per annum in historic seismic data acquisition and reprocessing, G&G studies and other technical work to be largely supported by the Company's existing technical staff base currently supporting operations in The Bahamas. Apart from the costs of completion of the minimum work program there are no annual licence fee payments, and no drilling is required in the initial four-year period, with extension into a second exploration period entirely at BPC's election.

OFF-1 has many operational and subsurface similarities to BPC's licences in The Bahamas - the Uruguay and Bahamas acreage is in similar water depths, both contain multiple, lower exploration risk structural plays in addition to the high impact fans, and both have material volume scope and extensive running room.

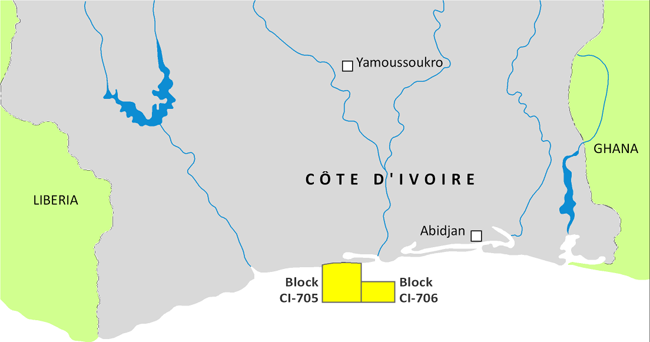

Qatar Petroleum l Côte d'Ivoire

In May 2020, Qatar Petroleum entered into a farm-in agreement with Total to acquire a 45% participating interest in blocks CI-705 and CI-706, located in the Ivorian-Tano basin, offshore the Republic of Côte d'Ivoire.

The two blocks cover an area of approximately 3,200 square kilometers, and present multi-target hydrocarbon prospects in water depths ranging from 1,000 to 2,000 meters, 35 kilometers from shore and about 100 kilometers from nearby Foxtrot, Espoir and Baobab fields.

Commenting on the agreement, His Excellency Mr. Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of Qatar Petroleum said, “The acquisition of working interests in these two blocks marks an important addition to QP’s upstream portfolio in Africa, and represents the first investment for QP in Côte d'Ivoire. Africa’s offshore is a key target area for QP’s international growth strategy.”

Fugro l Taiwan

In April 2020, Fugro established Fugro IOVTEC Co. Ltd (Fugro IOVTEC), a Taiwanese entity to support ongoing business expansion in the emerging offshore wind farm market in Taiwan.

Fugro has been actively supporting the renewables market in Taiwan since 2016 under a Memorandum of Understanding (MOU) with IOVTEC. The creation of Fugro IOVTEC formalises Fugro’s long-term presence in the country to optimise their renewables growth strategy. The Fugro IOVTEC office will be established in the coming months and an in-country soils laboratory will be set up to service their renewables client base.

Ascent Resources l Cuba

In April 2020, Ascent Resources announced its first transaction in Cuba, comprising the acquisition of Energetical, a UK Company with exclusive rights to secure a Production Sharing Contract ('PSC') on a producing onshore Cuban oil licence. Energetical delivers exclusive rights to the 9B Block in Cuba that contains the onshore Majaguillar and San Anton fields, located on the North coast of Cuba and currently producing 190 bbls/day gross from three wells.

The Company is reviewing potential further acquisitions to develop a broad Cuban portfolio across both oil and gas and potentially mining.

Shell/Exxon l Somalia

In March 2020, The Ministry of Petroleum and Mineral Resources of the Federal Republic of Somalia, agreed on an initial roadmap with the Shell/Exxon joint venture focused on the next steps towards the exploration and development of certain offshore hydrocarbon blocks.

This co-created roadmap will enable the conversion of prior agreed concessions into Production Sharing Agreements (“PSAs”) under the provisions of the Petroleum Law. This builds on the agreement signed in Amsterdam on 21 June 2019 which led to the receipt of USD$1.7 million from the Shell/Exxon joint venture from historical surface rentals and other incurred obligations on Offshore Blocks.

Navitas Petroleum l North Falkland Basin

In January 2020, Rockhopper and Premier Oil signed a detailed Heads of Terms with Navitas Petroleum LP to farm in for a 30 per cent interest in the Sea Lion project.

Working interest in Sea Lion licences PL032, PL004b and PL004c to be aligned: Premier 40% (Operator); Rockhopper 30%; Navitas 30%.

KeyFacts Energy: New Kid on the Block

KEYFACT Energy

KEYFACT Energy