Angus Energy today announced that the Loan Facility, conditional only on the setting of the hedge, regulatory approval of the royalty arrangement by the Oil and Gas Authority (the "OGA") and a handful of administrative provisions, has now been signed between Angus and Saltfleetby Energy Limited, as Borrower and Guarantor respectively, and Mercuria Energy Trading Limited ("Mercuria") and Aleph Saltfleetby Limited ("Aleph"), as the co-Lenders. As previously notified, the Company awaits approval of the Field Development Plan from the OGA although this is now expected to follow the initial drawdown under the Facility.

The terms of the Loan Facility remain substantially unchanged from those advised in our RNS of 30 November 2020 with changes to the profile, but not amount, of shares issued to Lenders, to be detailed at drawdown, and tighter provisions on change of control.

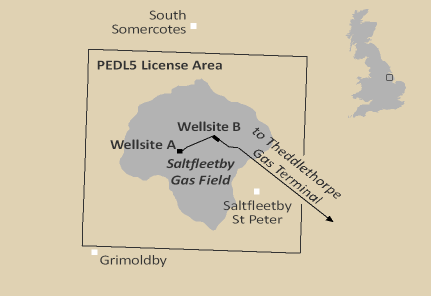

Map source: KeyFacts Energy

George Lucan comments:

"We are delighted to have signed the Loan Facility and when completed to have the financial support of Aleph and Mercuria, which combined will unlock the substantial shareholder value of the Saltfleetby Gas Field as well as provide financial, commercial and technical support for Angus's energy transition plans. Attaching this calibre of funders demonstrates the quality of the Saltfleetby asset and further validates the strategic direction of the board. I look forward to continuing to work closely with our new funders as we develop this field and our other projects.

We have continued to progress the detailed engineering design for the rehabilitation of Saltfleetby during the documentation process and have decided, with the support of the Aleph and Mercuria, to drill the third production well at Saltfleetby before reconnecting the two existing gas wells. This will allow us to begin with the daily plateau production of 10mmscf originally envisaged by the Competent Person's P90 case, immediately after the new processing facilities have been commissioned and as such it is expected that first gas will begin in Q4 2021. The timing of this will allow us to benefit immediately from winter gas prices at the capacity rate of the facility thus enhancing the initial revenues from the field.

Concurrently, we are progressing our potential geothermal projects in the South West, while evaluating other acquisitions and renewable opportunities with our new funding partners and investors. I look forward to updating the market on this in the coming months."

Jason Joannou (Aleph Commodities Ltd) comments:

"The funding and redevelopment of the Salftleetby Gas Field is a key milestone for Angus, cementing its position in a region which is developing into one of the UK's leading renewable energy hubs. Working with Mercuria, Albanwise Synergy (a leading renewables developer and partner of Aleph) and Aleph will provide Angus with the financial, commercial and technical support to develop new projects and achieve their Energy Transition goals."

David Haughie (Managing Director at Mercuria Energy Trading Limited) comments:

"We are pleased to participate in the re-development of Saltfleetby and look forward to working with the Angus team beyond this first transition project, on their wider portfolio of future geothermal and other sustainable energy opportunities."

Frazer Lang (Executive Director, G.P. Jersey, major shareholder) comments:

"I would like to congratulate the Angus Energy board on achieving this significant milestone, this debt facility allows Angus to monetise the Saltfleetby Gas Field, which is the key to unlocking significant shareholder value."

KeyFacts Energy: Angus Energy UK country profile

KEYFACT Energy

KEYFACT Energy