Lansdowne Oil & Gas today announced its unaudited results, for the six months ended 30 June 2022. Lansdowne is an upstream oil and gas company, focused on exploration and appraisal activities in the North Celtic Sea Basin, off the south coast of Ireland. The Company has targeted the Irish offshore shelf areas close to existing operating infrastructure for exploration, as these provide shallow water (generally less than 100 metres), and relatively low drilling costs and the Directors believe that these factors, combined with favourable fiscal terms, have the potential to deliver high value reserves and consequential shareholder value.

First half operational highlights

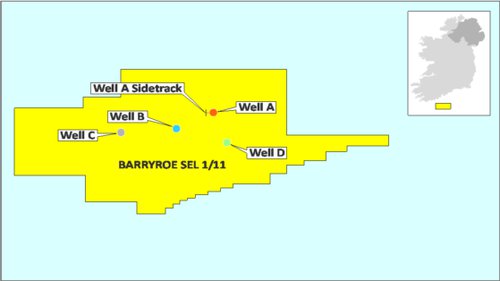

Barryroe Oil Field (SEL 1/11)

- Lease Undertaking Application remains under active consideration at the Department of the Environment, Climate and Communications ("DECC")

- We now look forward to engaging constructively with DECC in the coming weeks following a recent encouraging update from the Minister

- New reservoir and development studies to assess potential of first Phase development of Barryroe, centred around the 48/24-10z area were completed

- New CPR completed by RPS over Phase 1 development area estimated 2C Resources of 81.2 million barrels recoverable, 16.4 million barrels net to Lansdowne

Financial highlights

- Cash balances at 30 June 2022 of £0.20 million (31 December 2021: £0.20 million).

- Loss for the period after tax of £0.16 million (2021: loss £0.13 million).

- Loss per share of 0.02 pence (2021: loss 0.02 pence).

- The LC Capital Master Fund loan, due for repayment on 31 December 2021, was extended to 31 December 2022.

- As part of LCCMF's agreement to the Loan Extension, the warrants to subscribe for up to 26 million new ordinary shares in the Company, granted to LC Capital Targeted Opportunities Fund LP in December 2020 were extended to now expire on 31 December 2022, in line with the Loan Extension and the exercise price was adjusted to 0.525p/warrant (being the closing mid-market price on 29 December 2021).

- In March 2022, the Company placed 60,000,000 new ordinary shares with new and existing investors at a placing price of 0.5 pence per share, raising £300,000 before costs.

- Associated with the fund raise, 1,821,826 warrants were granted to LC Capital Targeted Opportunities Fund, LP in accordance with the provisions of LCCTOC's warrant instrument.

- LC now holds 27,821,826 warrants over ordinary shares and the strike price for these warrants has been amended to 0.5 pence per share from 0.525 pence per share pursuant to the LC warrant instrument.

Barryroe

Lansdowne have recognised for a long time that Barryroe should be developed in a phased manner rather than a large and more demanding full-field development.

The benefits of a phased approach is that it allows lower initial CAPEX and a shorter lead time to production and revenues.

During 2021, third-party technical studies were carried out to evaluate the potential of a first phase of development of the Barryroe Field, centred around the 48/24-10z well. These studies focused only on the oil-bearing Basal Wealden A Sand, that tested oil at a rate of 3,514 barrels of oil per day and gas at a rate of 2.93 million standard cubic feet per day.

As a result of these additional technical studies the Barryroe Partners commissioned a new Competent Person's Report, that was prepared by RPS Group Plc. and again, addressed the potential oil volumes in the Basal Wealden A Sand, the reservoir reviewed in the earlier full-field Competent Persons Report carried out by Netherland Sewell & Associates Inc. in 2012.

Overlaying the identified oil-bearing Basal Wealden A Sands are the important gas bearing C Sands. The 48/24-10z well tested strong gas flow rates from the C Sands.

The recent RPS Competent Persons Report did not address the gas volumes present in the overlying C Sand which Lansdowne believe are of significant volume and value and can provide important energy security for Ireland.

The RPS Competent Persons Report concluded that the Phase 1 development, in the P50 Case, has the potential to recover 81.2 million barrels of oil (16.24 million barrels net to Lansdowne) and deliver an NPV10% for Lansdowne's 20% share of $104 million under a Brent Oil Price assumption of US$68 per barrel in 2027, rising to $70/bbl in 2028 and 2029 and inflated at 2% per annum thereafter.

It is Lansdowne's belief that the development of Barryroe has taken on a critical energy security role for Ireland and the company look forward to expediting the development of this asset.

With the completion of the site survey over the K location in November 2021, Lansdowne can now move forward with the necessary appraisal well, which will address both the A and C Basal Wealden Sand reservoirs and clarify the split between oil and gas resource volumes.

Unfortunately, however, nothing can move forward without the granting of Lease Undertaking over Barryroe, the application for which was submitted in April 2021. This continues to remain under consideration by the Department of Environment, Climate and Communications ("DECC").

KeyFacts Energy Ireland company/country profiles: Lansdowne Oil & Gas

KEYFACT Energy

KEYFACT Energy