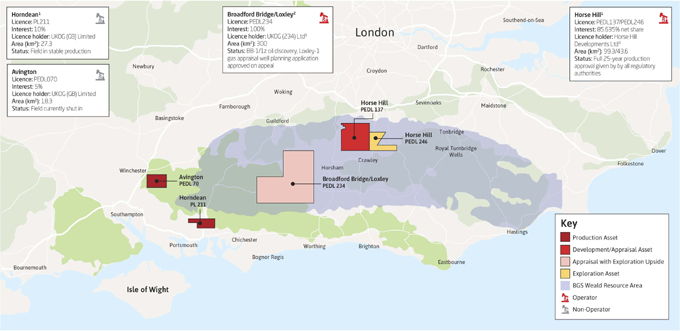

UK Oil & Gas today announced that its subsidiaries UKOG (137/246) Ltd (UKOG 100% interest) and Horse Hill Developments Ltd ("HHDL", UKOG 77.9% interest) have executed a conditional binding term sheet with LSE main board listed Pennpetro Energy ("PPP"), whereby PPP will farm-in to the Horse Hill Oil Field on an incremental production basis via funding the acquisition of 3D seismic and the drilling of the next infill production well. UKOG holds an 85.635% net interest in Horse Hill and the surrounding 142.9 km² PEDL137 and PEDL246 licences located about 2 km north of Gatwick airport.

Farmout Highlights:

- PPP to fund 100% of a new crestal infill production well, designated Horse Hill-3 ("HH-3"), to be spudded after the completion of a PPP 100% funded ~12 square km high-definition 3D seismic survey (the "Farmout Programme"), subject to an aggregate cap of £4.6 million.

- Upon Farmout Programme completion, PPP will earn a 49% share of any oil production from HH-3. PPP will also earn an aggregate 49% non-operated Licences interest, comprised of an initial 7% on 3D seismic completion and a further 42% interest upon HH-3 completion.

- UKOG and HHDL will retain 100% ownership and rights to all oil production and revenues from Horse Hill-1 ("HH-1"). UKOG will remain as the Horse Hill and Licences operator.

- The assignment of the aggregate 49% Licences interest to PPP is subject to PPP providing the necessary funds to drill HH-3 and complete the Farmout Programme within six-months from the completion of the 3D seismic which is at its discretion.

- Subject to farmout completion, UKOG's interest in HH-1 production will remain at 85.635% and its net interest in any HH-3 production and the Licences will be 43.67%.

- The farmout to PPP is subject to the completion of a formal Farmout Agreement between the Parties, formal consent by each Parties' respective boards, the full consent of all HHDL's shareholders and regulatory consent from the North Sea Transition Authority for any Licences interest assignment.

- Post Farmout Completion, each Licences participant will bear and pay cash calls pro rata to their respective interest in the Licences.

- Planning and environmental consents remain in place for a further 4 production wells at Horse Hill.

- 3D seismic acquisition is currently targeted for H2 2023.

Stephen Sanderson UKOG's Chief Executive commented:

"This mutually advantageous transaction will inject new activity into Horse Hill, aiming squarely to deliver increased production and revenues from the oil field. The farmout enables UKOG to move this asset forwards without the need to raise capital, enabling our resources to be firmly focussed upon the appraisal and development of the Loxley gas discovery, our most material petroleum asset. We look forward to a close working relationship with Pennpetro and a mutually successful future at Horse Hill."

About Horse Hill

Following its discovery in 2014, Horse Hill was successfully production tested in the Upper Portland sandstone and underlying Kimmeridge section from 2016 through to the start of long-term continuous Portland production in 2020. As of mid-March 2023, continuing oil production from HH-1 totals an aggregate of over 185,000 barrels of 35˚- 41˚ API sweet crude. Full planning and environmental consents are in place for four additional infill production wells.

In addition to the 132,000 barrels of 35-36˚ API Portland continuous production, approximately 53,000 barrels of 41˚ API sweet crude were produced from multiple zones within the underlying naturally fractured Kimmeridge section during production testing, before being shut-in to permit longer term Portland production. The Kimmeridge therefore remains a potentially viable secondary conventional production target at Horse Hill.

A 2018 Xodus Competent Persons Report estimated a gross mid-case Portland oil in place of 30 million barrels, with a corresponding mid-case 2C recoverable Contingent Resource of 1.494 million barrels. The estimated mid case 5% recovery factor being stated to be in accord with other analogous fields in the Weald Basin. It should be noted, therefore, that the total HH-1 Portland production to date potentially leaves approximately 1.362 million barrels of the estimated mid-case 2C Portland recoverable resource available to infill drilling and remaining HH-1 production.

It should be noted that, at present, the potential additional recoverable volumes stated in this announcement are defined as Contingent Resources and should not be construed as Reserves. Further development of the asset via a successful Farmout Programme would be required to seek to move the classification to Reserves.

As per the Company's RNS of 27th February 2023, the field's forthcoming water injection programme seeks to improve net earnings from HH-1 and the wider field by approximately £250,000 per annum by eliminating the substantive costs of tankering and disposal of produced saline formation water at distant third-party sites. The planned injection will also help maintain reservoir pressure which can help improve ultimate oil recovery from HH-1 and a future HH-3 well. The removal of tankering will also reduce the field's overall carbon footprint.

For the year ended 30th September 2022, production operations from Horse Hill (HH-1) returned a gross profit of £0.243 million and the Licences an overall loss of £0.15 million.

Pennpetro

Pennpetro Energy (PPP) is an oil and gas company focusing primarily on production and development in Texas, USA. Its wholly owned subsidiary, Nobel Petroleum USA Inc. has a Participation, Development and Option Agreement and Joint Operating Agreement with Texas based Millennium PetroCapital Corporation over a 250,000 acre Area of Mutual Interest in Gonzales County, Texas, aimed at exploiting the prolific proven Austin Chalk oil and gas play.

KeyFacts Energy: UK Oil & Gas UK country profile

KEYFACT Energy

KEYFACT Energy