A wave of new opportunities for the UK’s world class offshore energy supply chain will be created by upcoming oil and gas projects, according to new figures.

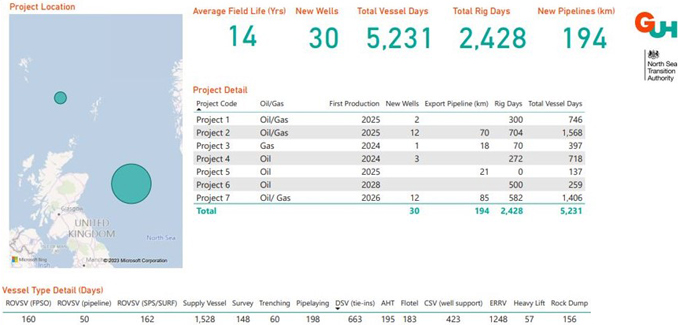

Research has identified seven near-term projects which will require 30 new wells and 194 kilometres of pipeline. The core study also showed that vessel and rig owners will be especially in demand as their services will be needed for more than 5,000 "vessel days” and nearly 2,500 "rig days”.

Offshore work on most of those developments is expected to get under way this year or in 2024 – subject to robust net zero regulatory assessments being passed – which presents significant opportunities for operators and the supply chain to collaborate and take advantage of this visibility when planning for asset, workforce and infrastructure availability.

Operators supplied the statistics for the seven projects in late-2022 to the North Sea Transition Authority (NSTA), which has been working closely with the Global Underwater Hub (GUH) to highlight the impressive scale of opportunity across the supply chain.

Environmental statements for five additional near-term projects were also analysed as part of the wider study. They would require a further 17 wells, 128 kilometres of pipeline, around 3,400 vessel days and 1,400 rig days.

The figures show that domestic oil and gas projects will continue to drive economic growth, safeguard employment for hundreds of existing skilled workers, create opportunities for future talent, and bolster the UK’s energy security.

They also emphasise the substantial volume of rig and vessel capacity required from a supply chain which has faced significant pressures in recent years, amid the prolonged downturn which started in late-2014, and was worsened by the COVID-19 pandemic.

Operators also face competition for equipment and skills from other oil and gas producing regions and the UK’s burgeoning offshore renewables sector, whose continued growth relies on many of the same resources. It is, therefore, vital that operators collaborate with suppliers and share their plans early, helping ensure that resources are available at the right time, and that commitments to support the UK’s service sector are met.

Details of eight of the 12 projects included in the wider study – Avalon, Cambo, Captain EOR Phase II, Jackdaw, Murlach, Rosebank, Talbot and Teal West – can already be found on the NSTA’s Energy Pathfinder portal, which provides greater visibility of upcoming tendering opportunities. The remaining four will be added in due course.

Pathfinder helps operators connect with suppliers by giving them a platform to advertise contracts they intend to award for oil and gas and renewables projects, while contact details of procurement managers are also displayed.

In addition, the NSTA will continue supporting the service sector by meeting regularly with operators to stress the importance of maintaining good working relations with their suppliers, in line with the NSTA's stewardship expectations.

The NSTA also requires operators to complete Supply Chain Action Plans, which are used to demonstrate that they are generating as much value as possible from their projects through open engagement with suppliers.

Bill Cattanach, NSTA Head of Supply Chain, said:

"This new research provides clear evidence that companies with vessels and rigs on their books can look forward to plentiful near-term project opportunities in UK waters. To fully capitalise on them, effective collaboration across the industry is absolutely vital.”

Neil Gordon, GUH Chief Executive, said:

"It’s more imperative than ever that we have a joined-up approach to these developments which takes account of the vast scale of all opportunities on the horizon for the subsea supply chain. Industry must have confidence in the regulatory environment, leading to visibility and, more importantly, surety of the domestic project pipeline.”

KEYFACT Energy

KEYFACT Energy